- Policy Proposal

- Macroeconomics, Economic Policy

Preventing “Housing Refugees”: A Proposal for a Home-Buying System

July 13, 2009

With bonuses slashed this year, many people will be hard pressed to keep up their mortgage payments. Some will see their homes repossessed and will become housing refugees, still saddled with debt. The government facilitated mortgages as part of its economic policy; now measures are urgently needed to prevent mortgage defaults.

Japan’s Average Household Could Disintegrate This Summer

The Japanese employment system has long revolved around the traditional practices of lifelong employment and predictable pay rises determined by seniority and length of service. These practices are now going through a huge change. There is no shortage of companies doing away with traditional bonus payments and replacing them with performance-based bonuses or annual salary systems. As the word itself suggests, a bonus should be a special premium tied to things such as business conditions or the company’s performance. The Japanese salary system in place now, however, does not work like that. The bonus is not a premium linked to individual performance, but is simply a fixed payment based on the monthly salary, usually two or more months’ salary, paid twice annually. Even when business is down for the company or the employee’s performance is not up to par, a basic bonus has always been paid. The bonus in Japan has thus come to be effectively a part of the annual salary, in which sense it is a deferred wage payment. This system is a product of Japan’s steady economic growth in the past. It is a method allowing company managers to keep monthly salary payments down and thus increase their operating capital. At the same time, it has been inspired by companies’ calculations that employees who stood to receive a share of the profits coming from increased performance would be inclined to work better.

However, since 1990 Japan’s economic growth rate has languished at around 2%, making an overhaul of the employment system inevitable. Some companies opted to introduce an American-style system of performance-based pay, while other companies looked to the European system of work sharing. The implementations varied from company to company, but there is no doubt that the country’s employment system became increasingly diverse.

The system of housing loans in Japan was built on the basis of an unchanging wage structure. Many mortgages include extra repayments at bonus time, on the assumption that a summer and a winter bonus will be paid every year—civil servants and employees of many listed companies receive bonuses in June and December. Keeping regular monthly payments down has led to a vigorous uptake of mortgages.

As a result of the global recession sparked by the 2008 financial crisis in the United States, Toyota Motor Corporation and many other manufacturing companies cut back production, and many blue-collar workers had their wages reduced. With monthly incomes shrinking, people began falling behind on their mortgage repayments, and it became increasingly common to hear of homes being auctioned off, or people selling their homes by private contract through realtors before the courts forced an auction. It seems likely that numerous people will be unable to make the extra bonus-time mortgage repayments this summer, and will lose their homes; the result will be a huge surge in the number of housing refugees, whose family lives have disintegrated. According to Nippon Keidanren (Japan Business Federation), an organization mainly of companies listed on the first section of the Tokyo Stock Exchange, the average summer bonus paid out by its member companies will be 19.4% less than last year, the biggest drop ever. There is, of course, a similar situation with the bonus payments made to employees of small to medium-sized enterprises, although it is easy to imagine that the decrease will be even greater.

Japan does not have a system of nonrecourse loans, meaning that even after a home used for collateral to secure a housing loan has been sold off, the borrower is still obliged to repay the remainder of the loan. It looks very much as though there will be a huge number of people with dwindling incomes, remaining debts to pay off, and no homes to live in.

Emergency Measures Are the Government’s Responsibility

With a crisis looming, the Tokyo Foundation’s Retail Finance Policy research project, led by Chief Research Fellow Kazuo Ishikawa, in June 2009 released its emergency “Proposal for a Home Buying System to Prevent Housing Refugees.”

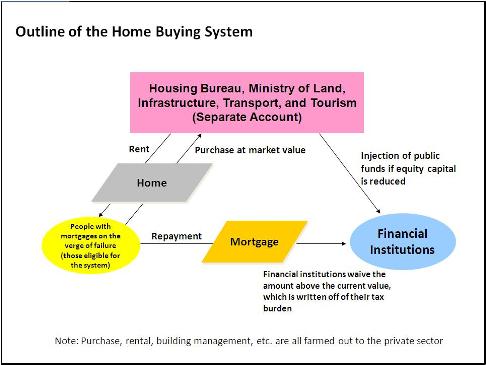

The Tokyo Foundation presented this proposal for a system of house purchasing to the government—specifically, the Ministry of Land, Infrastructure, Transport, and Tourism. Its major policy objectives are providing a safety net as a precautionary measure to prevent personal bankruptcies, averting a drop in real estate prices, and preventing a crunch in lending by financial institutions.

Mortgages have always been financial products that stand on their own merits, provided that careful repayment plans are drawn up and stuck to. However, since the 1970s the Japanese government has carried out a policy of facilitating mortgages through the Government Housing Loan Corporation (now the Japan Housing Finance Agency) as a key element of its economic measures. At its peak, the corporation had lent in excess of 70 trillion yen in mortgages. The government also started reducing the tax on mortgages in 1986 by making a fixed proportion of the balance of the mortgage income-tax-deductible, in the expectation that encouraging home ownership would have an economic ripple effect. Given this background and the particular features of the mortgage system in Japan, it would appear only proper that the government should shoulder the responsibility of preventing people becoming housing refugees.

A brief overview of the proposed system is as follows. The government purchases at current market price the homes (land and houses) of people whose mortgages are on the verge of failure—those for which repayment is in arrears or the guarantor has been forced to step in and take up payments. The capital for the purchase of homes comes from a fund set up by the government. People whose homes have been purchased by the government then repay the mortgage to the financial institution with the proceeds of the sale of the home. If the mortgage was greater than the current value of the home, the financial institution waives the amount above the current value, and this sum is written off of the institution’s taxes. In the event that waiving the debt reduces the equity capital of a financial institution, the government will use public funds to increase the capital in order to prevent a credit crunch. People receiving assistance under this system will be able to rent the property and live in it for a fixed period. The successive operations that this system entails will be farmed out to financial institutions, realtors, and other private-sector businesses. The system is illustrated in the diagram below.

A Longer-Term Proposal

The repayment term for a mortgage (the term of the loan) is generally set at 35 years, but this length and the method of repayment are no longer appropriate at a time when employment is showing great liquidity. Moreover, real estate prices are no longer soaring now that the myth of ever-increasing land prices has collapsed. If the price of land fluctuates, real estate prices also go up or down. It is usual in Japan for buildings to be valued very low and to lose almost all their value 10 years after construction. A home is essentially a commodity, but taking out a long-term loan worth several times one’s annual income for a commodity that is likely to lose its value represents a huge risk for the individual buyer.

From a medium- to long-term perspective, we must rethink the idea of extending support to people with mortgages as an economic stimulus measure. With the policy of facilitating home construction by applying favorable interest rates to mortgages, the benefit and the risk become apparent at different times—the economic effects are felt straight away, while the risk of rising interest rates is spread over the long term. There has always been the expectation of an economic ripple effect if the number of home purchases increases, because people tend to buy furniture and household appliances when they buy a home. However, while the effects of a short-term increase in purchasing power are recognized, these are no more than minor purchases attached to a major, long-term debt. The national policy of encouraging people to take out mortgages should cease immediately.

Taking stable real estate prices and rising interest rates into account, there should be a policy of facilitating not just home purchasing, but also the construction of rental housing units. Companies have long helped to offset the cost of rented housing as part of their employee welfare programs, but this is now tending to decline. From the housing policy perspective, help for renters is needed in order to spread the benefits evenly throughout the whole population. While some thought needs to be given to the cost-effectiveness of administrating public subsidies and to the administrative overhead, it would be worth investigating a system in which a fixed benefit is paid to people on low incomes without specifying how it is to be spent, giving the option but not the obligation to use it for housing costs. One possibility is the system of paying benefits to people on low incomes in lieu of income tax cuts, which would not be as much benefit to those in this bracket who pay little or no income tax in any case.

The policy of encouraging people to buy homes even if it means taking out mortgages they cannot pay off is essentially the same approach as the sub-prime mortgage lending in the US, and the end result is likely to be the same. Government policy in this area needs adjustment. At the same time, there needs to be an environment that enables home buyers to take out mortgages based on prudent payment schedules.

The “Proposal for a Home Buying System to Prevent Housing Refugees” is an emergency proposal by the Tokyo Foundation’s Retail Finance Policy research project, led by Chief Research Fellow Kazuo Ishikawa. The project members involved in compiling the proposal were: Kiyoyuki Tomita, Senior Consultant, Shin Nihon Public Affairs Co., Ltd.; Masaru Ikoma, Managing Director, Strategy and Practice Coordinated Consulting; Takashi Suzuki, Director of the Policy Research Division and Research Fellow, the Tokyo Foundation; Takahiro Sato, Project Manager of the Policy Research Division and Research Fellow, the Tokyo Foundation; and Takahiro Akagawa, Project Manager of the Policy Research Division, the Tokyo Foundation.