Will the Chinese economy lose steam after the Beijing Olympics? The author visited China's economic hub of Shanghai just before the games to speak with key economic figures there. His findings form the basis of his analysis of China's economy in the near future.

* * *

China's economy has enjoyed annual growth in the double digits over the last five years, but many observers are now warning of a drastic slowdown to follow the Summer Olympics held in Beijing this year. In the first half of calendar 2008 the Chinese gross domestic product reached 13.619 trillion yuan, or around 200 trillion, marking 10.4% annual growth in real terms. This does, in fact, represent a slowdown of 1.5 points from the 11.9% growth the economy marked in 2007.

In this paper I will use the latest statistical data to analyze the present state of the Chinese economy. I will then attempt a forecast for the course of the economy from here on out, drawing in particular on the views I heard during a trip I took to Shanghai from July 19 to 25, 2008, from people in Japanese companies with operations in China, economics officers at the Japanese Consulate-General, the chief representative of the Bank of Japan's Beijing office, Japanese economists stationed in China, representatives of China's state-run banks, and Chinese economists.

My conclusion is that the Beijing Olympics will have only the slightest impact on the nation's economy, which will continue to grow at a solid 9%-10% annual rate in the second half of 2008. However, factors including rising prices, a fall in the value of home sales, and a credit contraction may end up putting a damper on individual consumption and corporate investment. According to the people with first-hand knowledge of Chinese conditions, there are already advance signs of slowdowns in consumption and investment. The situation will continue to bear close attention.

(1) The Effect of the Olympics

The question of whether the Chinese economy will see a drastic slowdown as soon as the Olympics end is easy to answer: There is no chance of a scenario where the economy loses momentum in the second half of the year as a direct result of the end of the Olympics.

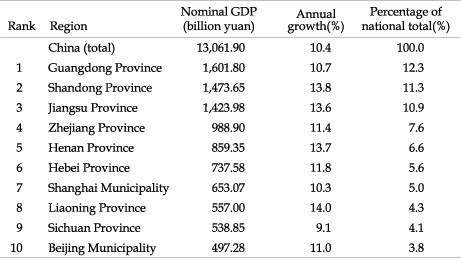

The reason for this lies in the relative importance of Beijing to the nation's economy. In comparison with Japan, where the capital of Tokyo and the three prefectures surrounding it comprise fully 25% of the nation's population and account for 30% of GDP, China has a capital with a much smaller economic footprint. The economy of Beijing is just 3.8% of the national GDP, ranking it tenth among all 32 of China's provinces, directly controlled municipalities, and autonomous regions. The influence of Beijing's economic fortunes on those of China as a whole is decidedly limited.

Table1: Regional Comparison of China's GDP (First Half 2008)

Why, then, is the GDP growth rate trending downward in China? Below I will examine GDP from the demand side, looking specifically at the three areas of consumption (final consumption expenditures), investment (in capital assets), and trade margins (net exports), reviewing the economic conditions in the first half of 2008 and exploring the potential for a slowdown in Chinese growth.

(2) Consumption (Final Consumption Expenditures)

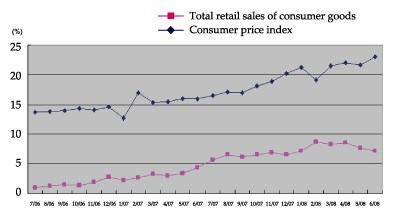

During the first half of 2008 final consumption expenditures reached a total of 5,104.3 billion yuan in China, a 21.4% leap from the first half of 2007. Beginning in 2004 total retail sales of consumer goods grew by more than 10% year-on-year, with growth topping 15% and moving even higher in more recent periods. In the first half of 2008 in particular, consumer prices rising by 7%-8% annually pushed the retail sales numbers even higher. Taking this into account makes it clear that despite inflationary pressure, personal consumption has maintained solid growth in 2008, remaining at around the 10% level marked in recent years.

Figure1: Retail Sales and Consumer Price Index Trends

The rise in consumer prices is the factor most likely to impact consumption in the second half of 2008. I take an optimistic view of this impact, though, because of rising household incomes, which are outpacing even the rate of increase in prices.

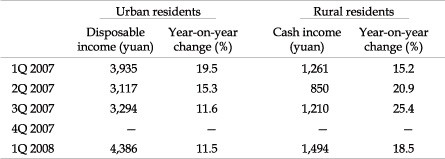

The disposable income of urban residents climbed by 11.5% in one year, from a household average of 3,934.9 yuan for January-March 2007 to 4,385.6 yuan for the first quarter of 2008. Rural households, too, saw an 18.5% climb in their cash income over the same period, from 1,260.3 yuan to 1,493.8 yuan.

Table2: Household Income Growth

Some observers claim to see signs that consumption is beginning to slow, however; the situation requires continued attention. In late July 2008, when I spoke with people from Japanese electronics makers with operations in Shanghai, I learned that despite the relatively high temperatures, sales of air conditioners are disappointing this summer, and are expected to fall by some 40% from last year's sales levels.

(3) Investment (Corporate Investment in Capital Assets)

China's total investment in capital assets during the first half of 2008 reached 6,840.2 billion yuan, up 26.3% from the first half of 2007. The rate of increase is also rising annually; from 2006 to 2007 the growth rate of this investment was 25.9%, 0.4 point lower. Investment in corporate assets has therefore represented roughly the same contribution to national GDP in the first halves of both last year and this year.

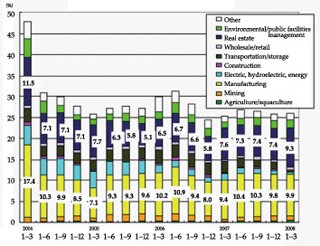

An examination of individual industries shows that the real estate industry accounted for 9.3 percentage points of the overall year-on-year rise in capital asset investment in the first quarter of 2008, a figure up 1.7 points from the same quarter in 2007. Around 70% of the investment in this industry is related to housing, an area that has seen rapid growth of more than 20% every year since 1997. Housing investment is a key engine of growth for the Chinese economy as a whole. Looking at the manufacturing sector for the same quarters, the contribution of capital asset investment climbed by 0.5 point from 2007 to 2008. Housing and manufacturing were the primary drivers of investment growth in China during the first half of 2008. Given the continuing vigorous investment in these two sectors, it is possible to forecast similar levels of growth for the second half of the year.

Risk factors here that could drag investment downward include a plunge in housing prices and tightened credit.

Figure2: YOY Growth in Capital Asset Investment by Industry

Source : CEIC Data Co., Ltd.

(4) Trade Margins (Net Exports)

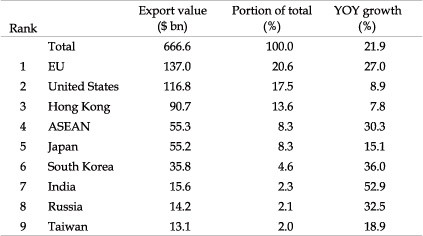

In comparison with strong domestic demand, external demand for Chinese products has been soft recently. In the first half of 2008 Chinese exports totaled $666.25 billion. While this was a healthy 21.8% rise from the first half of 2007, this growth was down fully 5.8 points from a year earlier.

This slowdown in export growth combined with a rapid rise in imports in 2008. Total imports for the first half of the year reached $567.55 billion, up 30.6% from the previous year. This considerable rise in the value of imports can be ascribed to climbing import volumes, against the backdrop of growing Chinese demand sparked by economic growth, and to skyrocketing prices on the international markets for China's main imports, namely crude oil, petroleum products, iron ore, soybeans, and cooking oil.

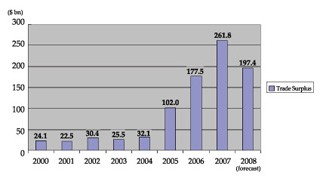

This combination of slowing exports and increasing imports resulted in a positive trade margin for China of just $98.7 billion for the first half of the year. This was an 11.8% decline from the first half of 2007. The shrinking trade margin is the primary factor behind the drop in the GDP growth rate during this period, and it looks set to continue affecting growth in the second half of 2008.

Figure3: Annual Trade Margins

There are three main reasons behind China's slowing exports: a drop in exports to the United States, a rise in the value of the yuan relative to the US dollar, and a fall in steel exports. In particular, exports to the American market can be expected to continue contracting, due to the slowdown of the US economy and the stronger yuan.

Recent years have seen China reduce its reliance on the United States as an export market, but America is still the largest single-nation market for Chinese goods, soaking up 17.5% of all Chinese exports. Moreover, other important export markets-Japan, ASEAN, Taiwan, and South Korea-are greatly dependent on the American economy. Taken together with the United States, these economies took in a total of 40.7% of Chinese exports as of 2007.

Zhu Jianfang, chief macroeconomic analyst at CITIC Securities, writes in the February 25, 2008, issue of Zhengquan shichang zhoukan (Securities Markets Weekly) that a 1% shift in the American GDP growth rate translates into a 6.08% shift in the same direction for Chinese exports to the United States, and that trends in the US economy will continue to exert considerable influence over the Chinese economy.

Table3: Major Markets for Chinese Exports (First Half 2008)

(5) Forecasting China's GDP Growth

As explained above, both consumption and investment can be expected to remain more or less at the levels of growth seen in the first half of 2008. China's trade margin, meanwhile, is likely to decrease further. Taken together, these factors mean that the Chinese growth rate should fall below the 10.1% marked in the year's second quarter. I forecast GDP growth in the 9% range for China in the second half of this year.