- Article

- Industry, Business, Technology

ESG Investing as an Antidote to Myopic Management

September 8, 2015

Investors can play a major role in promoting CSR by encouraging businesses to deepen their commitment to addressing social issues and restoring a long-term perspective to financial markets. Enabling socially responsible investment, says CSR expert Mariko Kawaguchi, requires the disclosure of a company’s environmental, social, and governance performance and policies, in addition to financial data.

* * *

To the extent that corporate social responsibility consists of efforts by individual companies to contribute to the resolution of social problems through their own business activities, investors have an important role to play as corporate stakeholders in promoting CSR. By using their own perspectives to assess corporate value on the basis of CSR criteria, investors can not only encourage businesses to deepen their commitment to CSR but also help restore a long-term perspective to financial markets that have become all too preoccupied with short-term results. In the following, I discuss the importance of a long-term approach and the role of environmental, social, and governance investment criteria in fostering long-term thinking, drawing on the results of the Tokyo Foundation’s CSR survey.

Long-Term Versus Short-Term Management

The global financial crisis precipitated by the 2008 Wall Street meltdown led to harsh scrutiny of the “greed is good” brand of finance capitalism. In fact, some of the major market players, recognizing the pitfalls of short-term profit seeking, have joined in the effort to reconsider the way these markets function. One focus of these reforms is to mitigate the emphasis on short-term results.

Many players have come to recognize the negative impact of short-term corporate valuation on financial markets—particularly the way quarterly financial reports affect corporate investment and stock prices. This priority on quarterly results encourages corporate executives to target their resources toward efforts to maximize sales growth during each three-month period, instead of research and development or other long-term strategic investment.

Take the case of a business that relies on timber resources. From the standpoint of quarterly earnings, it might be advantageous to boost the business’s short-term cost-competitiveness by importing cheap Southeast Asian lumber harvested through clearcutting, instead of pursuing the costlier option of sustainably managing its own forest. From a long-term perspective, however, such procurement practices not only destroy forest ecosystems and promote desertification but also impact the company’s future access to raw materials. In the case of agribusinesses, a short-term orientation is likely to discourage organic farming, which generally results in lower yields, and incentivize the large-scale application of agrichemicals to boost short-term yields, even at the cost of depleted soil and poor harvests farther down the road (not to mention the costs of the agrichemicals themselves).

One need not look far to find companies that have sustained serious damage as a result of myopic cost cutting. In the fall of 2013, Japan was rocked by a series of revelations regarding false labeling by top-tier hotels and restaurants. These establishments became the objects of stinging criticism after admitting to the use of cheap substitutes for more expensive ingredients like lobster. In April 2013, more than 1,100 garment workers died after a factory collapsed in Bangladesh, a major supplier of cheaply made apparel to companies around the world. This led to local demonstrations and major public campaigns by nongovernmental organizations directed against foreign businesses, which were ultimately forced to implement major changes in their supplier agreements to substantially upgrade working and living conditions for garment workers.

When businesses focus narrowly on near-term profits, they not only miss opportunities to maximize long-term gains but can even jeopardize their own survival through unethical or unsustainable practices, such as mislabeling, complicity in child labor or poor labor conditions, and indiscriminate sourcing of timber and other resources. Good quarterly performance can mask such practices, their impact on society, and their risk for long-term performance. Even while keeping an eye on short-term fluctuations in earnings, investors need to avoid being distracted by such “noise” and judge companies by their long-term business strategies if they want sustained performance.

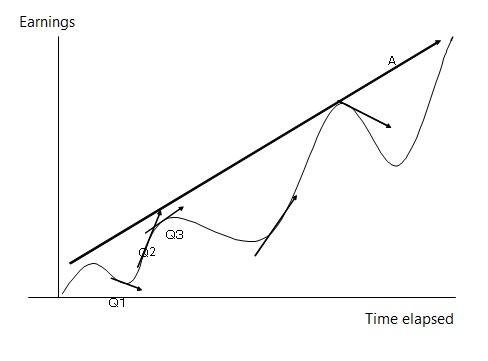

Quarterly financial results can also fluctuate widely in response to temporary developments, including stages in the product cycle, the presence or absence of a hit product, shifting customer preferences, exchange rate fluctuations, weather conditions, and tax payments. In order to determine a company’s true trajectory, investors must look beyond such passing events and scrutinize the long-term trend. Figure 1 is a schematic representation of the relationship between long-term and short-term trends.

Figure 1. Short-Term Business Forecasts and Long-Term Trends

The curve traces actual short-term performance. The slope of the curve at the end of each quarter (Q1, Q2, etc.) shifts dramatically from quarter to quarter, meaning that forecasts based on quarterly business performance would also fluctuate widely. But the long-term trend, represented by line A, is actually quite consistent. We should be using this trend line to make long-term assessments of business performance.

Long-Term Evaluation and ESG Investment

However, the figures companies are required to release are those corresponding to Q1, Q2, Q3, and so forth. What do investors need in order to see the big picture, represented by line A? In addition to financial data, they need information about a company’s environmental (E), social (S), and governance (G) performance and policies.

The rise of socially responsible investing (SRI), also known as ethical investing, dates back to the 1960s in North America and to the 1990s in Europe. It emerged and took hold as a niche strategy oriented to religious organizations, labor unions, and other asset owners anxious to avoid investing in businesses that violated their religious or ethical principles (corporations involved in alcohol or tobacco were a prime example).

Then around 2006, a different style of SRI began to gain ground. Commonly known as ESG investing, it is aimed at achieving better long-term performance and compliance with fiduciary duties by taking into account factors pertaining to the three basic elements of CSR: environmental responsibility, social responsibility, and good governance. This approach was codified in the Principles for Responsible Investment adopted in 2006. The PRI were drawn up under the leadership of major American and European pension funds, such as Calpers and Hermes, with the support of the UNEP (United National Environment Program) Finance Initiative and the UN Global Compact. They have gained widespread support from those involved in long-term asset management—including public pension funds—from the standpoint of promoting socially responsible investment geared toward compliance with fiduciary duties, better performance, and the resolution of social issues. As of the end of July 2015, a total of 1,357 institutions (including asset owners like pension funds, investment managers, and financial service partners) had signed on to the PRI and were pursuing ESG investing based on those principles.

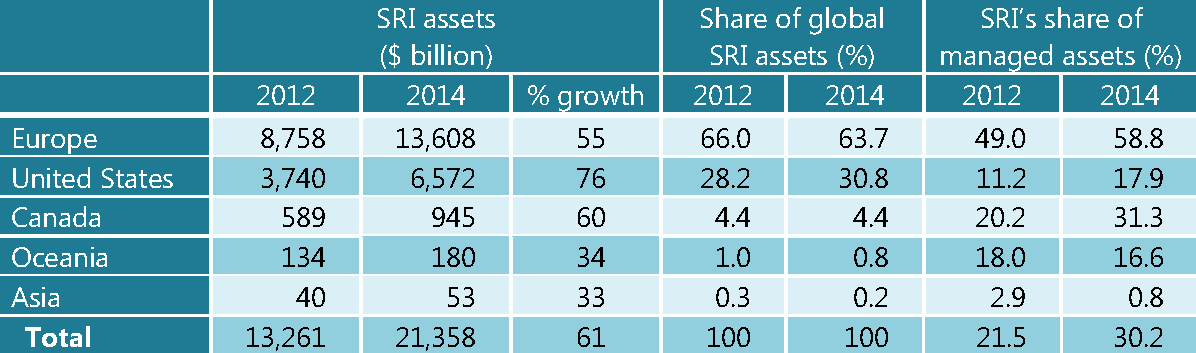

What is the overall scale, then, of ESG-conscious investing? According to the Global Sustainable Investment Review , published by the Global Sustainable Investment Alliance, the SRI market in all the regions covered by the report totaled $21.4 trillion in 2014, about 30.2% of the total. By region, Europe (63.7%), the United States (30.8%), and Canada (4.4%) accounted for nearly 99% of this investment. Of the remaining 1%, Oceania accounted for 0.8% and Asian countries for 0.2% of the global total (Table 1). [1] It is noteworthy that the European and the US SRI market expanded by 55% and 76%, respectively, between 2012 and 2014.

Table 1. Global Sustainable Investment by Region

The Significance of ESG Criteria

What are the factors driving the growth in ESG-conscious investment outside of Japan? As we have seen, one is the demand by investors for a more accurate and multifaceted evaluation of corporate value and performance. A second factor is the desire to contribute to the resolution of problems like environmental degradation and poverty through socially responsible investing. And a third factor is the growing recognition that ESG criteria provide a valuable tool for assessing corporate value over the long term.

How, then, do ESG criteria correlate with the assessment of corporate value?

The first point to keep in mind is that most key ESG goals, including environment-friendly business operations and sound human resources development, require long-term investment. For example, the administration of Prime Minister Shinzo Abe has placed great emphasis on more active participation by women in the workforce, but substantially increasing the percentage of executive posts occupied by women is a multiyear undertaking under the best of circumstances and in some settings may take a generation to accomplish. After all, women must be trained to function in executive posts, and in Japan, where executives generally rise up from the company ranks, such training must occur predominantly within each company. Similarly, environmental measures like afforestation and tree planting, clean-water programs, and other initiatives can take years or decades to show results. Large-scale investment in energy-saving equipment and processes generally pay off in cost savings as well as reduced CO 2 emissions, but they offer no financial benefits over the short term.

Using a sports analogy, quarterly performance can be likened to running a 100-meter dash, while CSR corresponds to an athlete’s overall physical condition as gauged by such fundamentals as weight, height, pulse, blood pressure, muscle tone and strength, and the health of the heart, the liver, and other internal organs. Of course, one needs more than strong muscles, heart, and bones to run like Usain Bolt. An athlete who suffers from a chronic ailment like heart disease or high blood pressure carries a high risk of collapsing. Maintaining good performance over the long term requires careful management of one’s total health and fitness. CSR is the health and fitness a company needs to run a good race, not only once or twice but repeatedly over time, with ESG corresponding to the specific components of that health, such as the muscles, bones, heart, and blood pressure.

At a December 2013 investment seminar organized by MSCI Japan—publisher of financial indexes for global investors—Executive Director Seiichiro Uchi explained the importance of ESG factors as follows:

- ESG factors examine a company’s adaptability and durability in the face of future changes in the game’s very premises. Traditional financial analyses sometimes took these factors into account, but the analyst’s focus was always on a company’s competitiveness and attractiveness at a certain moment in time.

- Child labor, worker exploitation, and other abusive labor practices are a major problem in many emerging markets. Yet traditional financial analysis offers no means of evaluating a company in terms of the role such practices play in its cost-cutting strategy. Without ESG expertise, it is impossible to judge whether a company should get high marks for cost cutting or low marks for human rights issues.

- Why is ESG important? Because there is a need to scrutinize corporate practices for their potential impact on society. [2]

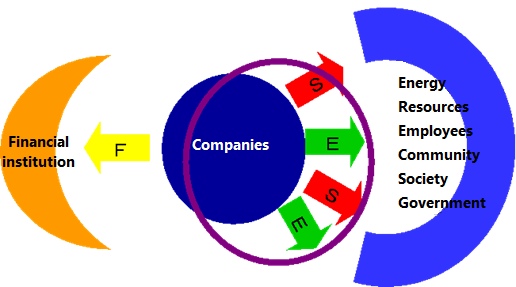

Figure 2 illustrates the relationship between ESG and financial figures. Using capital from investors and lenders, each corporation hires personnel (S), builds offices and plants in compliance with local rules and regulations (E, S), and uses energy and resources (E) under a unified management policy (G) for the purpose of providing goods and services at a profit (F).

Figure 2. Relationship Between ESG and Financial Results

Financial results (F) that investors watch closely are thus the outcome of ESG contributions. Yet until fairly recently, it was impossible to obtain data regarding each of these contributing factors, and in the absence of information to judge their impact on financial results, companies were evaluated on the basis of financial data alone. However, as companies began to incorporate CSR policies and programs into their management strategies and publishing CSR reports, more information became available from the companies themselves. Armed with this data, PRI signatories have been able to identify the ways in which ESG factors affect profit and risk, and investors have become increasingly interested in the correlation between ESG and long-term performance.

ESG and Long-Term Strategy

This trend has received a recent boost from the 2013 publication of the International Integrated Reporting Framework, compiled by the International Integrated Reporting Council, or IIRC. The framework defines integrated reporting as “a process . . . that results in a periodic integrated report by an organization about value creation over time and related communications regarding aspects of value creation” and defines an integrated report as “a concise communication about how an organization’s strategy, governance, performance, and prospects, in the context of its external environment, lead to the creation of value in the short, medium, and long term.” [3]

The International IR Framework identifies six forms of capital that contribute to the creation of value: financial capital, manufactured capital, intellectual capital, human capital, social and relationship capital, and natural capital. Students of economics and business who have been inculcated with the notion that there are three categories of capital may find it difficult to adjust to the idea of expanding the definition to include ESG factors, represented by the last three items. Classical economics treated water and air as free goods and did not recognize society or the community as capital. But given the growing global water shortage and the air pollution crisis affecting many parts of China, it is increasingly clear that clean water and air are finite assets that come at a price. The notion of human capital is perhaps less foreign, since classical economics classifies labor as an asset, and the idea of human resources as the core of a business’s nonfinancial value has become commonplace in recent years. By focusing on these “six capitals,” the International IR Framework helps clarify the connection between ESG and the process of value creation in order to facilitate decisions regarding sustainable investment using ESG criteria.

For fiscal 2014, more than 100 companies intend to prepare integrated reports, according to the IIRC. As a result of such initiatives, more and more companies can be expected to disclose key elements of their long-term business strategy, and such nonfinancial data can be expected to play an increasingly prominent role in investment decisions. Whether this trend bears fruit in Japan will depend on how well each company is able to integrate CSR into its strategy for long-term value creation.

Insights from the Tokyo Foundation Survey

What insights can the Tokyo Foundation’s Survey on Corporate Social Responsibility provide when ESG is regarded as part of a company’s long-term business strategy?

The survey asked businesses about their initiatives for nine social issues and the benefits of those efforts to the company. The responses overall indicate that most companies place low priority on areas in which CSR efforts are thought (by the CSR officer) to yield little benefit to the company or on areas with no clear connection to the company’s core business.

Topping the list in terms of CSR initiatives and perceived benefits were domestic and overseas programs aimed at environmental sustainability, followed by domestic efforts to raise the status of women. The emphasis on these two areas is not difficult to understand. Fifteen years ago, when the Kyoto Protocol was adopted, environmental efforts were still regarded as an aspect of social philanthropy. Nowadays they occupy a more central place in business strategy, functioning not only to reduce a business’s environmental burden and to cut costs but, in many cases, to spur the development of new goods and services for the global market.

The focus on women’s empowerment can be explained by such factors as the current administration’s goal of boosting women’s participation in the labor force, the large gap between the status of women in Japan and in the rest of the industrialized world, and the growing realization among many businesses that henceforth women must be part of any sustainable strategy for securing and developing human resources.

By contrast, only 31 of the companies surveyed reported that they were engaged in efforts aimed at fighting poverty and hunger in Japan, while 175 indicated that they were not. Those supporting programs to fight poverty and hunger overseas, on the other hand, numbered 74. This gap may reflect a view that poverty is a serious problem only in other countries, not in Japan. Or it may stem from a sense that the company has little to gain from domestic anti-poverty initiatives or that domestic poverty has little bearing on the company’s businesses. In any case, given the growing problem of the working poor in Japan and rising concerns over schoolchildren unable to pay the fee for their school lunch program, one cannot but feel that this is an area in need of greater attention.

Corporate initiatives to fight childhood poverty are likewise primarily undertaken overseas. On the other hand, initiatives pertaining to community involvement and the preservation of local culture were more prevalent in Japan, with 154 companies indicating that they had domestic programs in place but only 70 reporting such activities overseas. Among those respondents that claimed to be actively considering a community initiative of some sort, 129 said that the focus of the proposed initiative was domestic, and only 58 were considering such a program overseas. Perhaps this discrepancy stems from a relative lack of familiarity with and understanding of local customs in foreign countries.

In terms of how CSR activities benefit the companies that engage in them, most respondents emphasized the contribution to employee education, securing of qualified human resources, and corporate image. Very few reported a positive impact on business earnings from any CSR initiatives save those pertaining to the environment in Japan or overseas. In short, the economic impact of CSR policies on Japanese corporations thus far has been limited mainly to enhancement of overall corporate health, as discussed above, through improvements in human resource development and brand value that lead to value creation over the long term. The challenge facing Japanese CSR officers now is to convert such basic improvements into concrete performance.

Generally speaking, Japanese corporations seem eager to pursue mainstream themes that are easy for their CSR officers to grasp and that are already widely embraced by Japanese society. Issues that are serious but have a lower social profile are much less likely to receive attention from Japanese companies, even though programs targeting such issues might be of greater potential value to society. Even if the officers in charge of CSR recognize such an issue’s importance, they need the support of the people around them in order to mobilize the organization’s resources. And gaining that support is difficult unless the problem has escalated to a level where it can no longer be ignored.

Japanese society today faces a number of emerging issues, including child labor and other human-rights abuses, that have thus far received little attention yet pose serious long-term risks if not confronted and addressed. Inhumane treatment of animals is another emerging issue; in late January 2014, a convenience store chain suspended sales of a box lunch containing foie gras (a decision that drew lively debate on the Internet) following accusations of cruelty to animals. [4] The latter development highlights the need for greater awareness on the part of Japanese CSR officers of new horizons in corporate ethics—especially in the West, where rights issues increasingly apply to animals as well as human beings—and the need for companies to map out a clear policy in response to new issues and changing values.

The results of the Survey on Corporate Social Responsibility lead one to the unsurprising conclusion that Japanese companies are working fairly hard on the “easy” initiatives—that is, those that already enjoy a high level of public awareness and corporate support—but that they are less actively engaged in other areas. Instead of merely following the leader and ignoring low-profile issues on the grounds that no one else is tackling them, CSR departments need to focus on problems that are still relatively small in scale. Once a problem has spread and escalated into a major social issue, no one needs the CSR department to explain its importance.

I believe that one of the most critical jobs of a CSR officer is identifying and following emerging issues and their potential impact on the company. Henceforth an increasingly important aspect of CSR management will be identifying risks in previously overlooked areas of corporate responsibility. The companies that succeed in doing so will have the best chance of boosting and creating new value over the long term.

1. http://www.gsi-alliance.org/resources/

2. Seiichiro Uchi, “ESG toshi no nami” (The Wave of ESG Investing), summary of presentation to MSCI pension seminar, Tokyo, December 6, 2013.

3. http://www.theiirc.org/

4. http://www.family.co.jp/company/news_releases/2014/140124_01.pdf