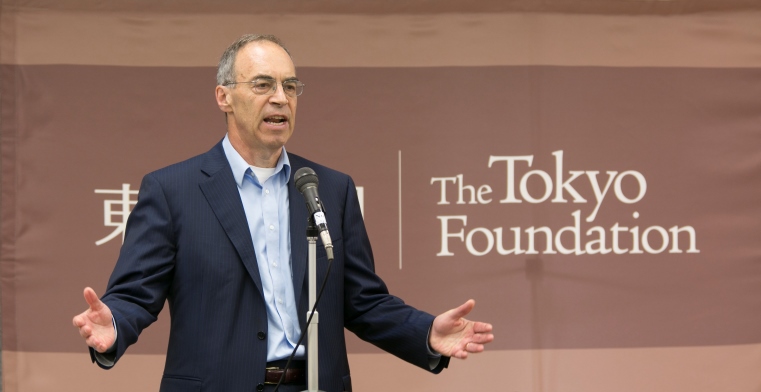

The following is a transcript of the keynote address, delivered by Alan Auerbach, the Robert D. Burch professor of economics and law and director of the Burch Center, University of California, Berkeley, at the Tokyo Foundation Policy Dialogue, August 2, 2017 (click to view presentation materials)

* * *

We’re in a period of some uncertainty about the future of US tax policy today, and I suspect that even in Japan, you realize that we’re experiencing an unusual period of chaos in the United States. So, in terms of prospects and roadblocks, I will talk about some standard issues that come up in this context, but you need to keep in mind that there’s an additional layer of uncertainty at present because of the environment in Washingtonーit’s very hard sometimes to focus on actual policy when so much else is going on. Nevertheless, I will try to do what I can.

Just to give you a quick outline of what I am going to talk about, the current state of play on tax policy in the United States is that we’re evaluating a number of alternatives, including one that I have been associated with much over the yearsーa destination-based cash flow tax. I’ll then provide an outlook for reform, including not only whether reform will happen but what its shape might be.

First, a reminder about the US form of government. We have a Republican-controlled government, but we have two branches of government that make decisionsーthe executive branch, run by the president, and Congress, the speaker of which right now is Paul Ryan and then there is also Mitch McConnell, leader in the Senate. The official language of describing how the US system works is, “the president proposes, and Congress disposes,” that is, there is this image of the president putting forward proposals that Congress then considers and modifies, but in reality Congress often comes up with its own ideas before the president puts anything forward. According to the Constitution, tax measures in Congress have to begin in the House of Representativesーthe lower houseーand the committee that handles that is the House Ways and Means Committee. So one often looks at the House Ways and Means Committee rather than the president to try to figure out where tax policy might be going.

After the election of President [Donald] Trump, which gave us a unified Republican-controlled government, an agenda was put forward for major legislation to take place in 2017, and the agenda was to do healthcare reform first and then tax reform, and the plan was to do both using the so called budget reconciliation process. To understand this fully, you probably need to be a parliamentarian. There are probably three or four people in the United States who fully understand how this works, but in the Senate, bills can be objected to using a filibuster process that requires 60 votes to overcome that process. However, there is an exception for budget reconciliation, which happens once a year, and the budget reconciliation process by which the final budget is arrived at for each fiscal year is handled by a simple majority. And therefore if you want to do something by a simple majority, and the measure you are thinking about is of a fiscal nature that deals with increases in spending or changes in spending revenues, you can do that through the budget reconciliation process.

In part because of the dysfunction of the US government, we haven’t had a budget for the current fiscal year 2017, and so we had the bonus of having two budget reconciliation processes available to use, and so the plan was to use the first 2017ーthe tardy budget reconciliation processーfor healthcare and then to use the next fiscal year’s reconciliation process for tax reform, pushing each one through with a majority, given that the Republicans have 52 seats, and that would have been enough if they acted in unified fashion.

Well, we’ve seen how that worked with healthcare reform, where there were a series of attempts leading ultimately to failure to come up with something to repeal and replace the Affordable Care Act, which was one of the landmark pieces of legislation during the [Barack] Obama administration.

So, at least for the moment, they have now turned the page on that and moved forward to the so called House Blueprint. At least, that’s the starting point which was proposed in June 2016. Now, just to give you an indication of what that proposal was, this was put forward before the election, so it was more or less a statement of principles by Republicans who controlled the House even then. They wanted to have individual tax cutsーa pretty standard Republican proposalーand then a fairly novel business tax proposal, not only to reduce the tax rates to 20%, which is a big tax cut, but also to move to a destination-based cash flow tax, which would represent a major change in the way we tax businesses.

Now, subsequently, in April, the Trump administration put forward what was described as a new plan for tax policy. Those who looked at it they realized right away that it was actually not a new plan. It was the same plan that the President put forward during the presidential campaign, and it also lacked specifics. It was a one-page document which, for those of us who work in tax policy, the notion that one could describe a complicated tax plan in one page does strain one’s imagination.

The proposal also would have been for a reduction in individual tax rates, a major reduction in the business tax rate to 15%, a move to a territorial system, which is something Japan has done in recent years, elimination of the state tax, and elimination of many personal tax deductions. Now, even with the elimination of the personal tax deductions, this plan as estimated by a nonprofit organization in Washington would have generated an enormous revenue loss, about 2.6% of GDP, which is about 14% of Federal tax revenues.

The plan as proposed by President Trump did not include the destination-based cash flow tax, and it’s important that he keep that in mind because the destination-based cash flow tax included a border adjustmentーsometimes called a border tax adjustmentーwhich is estimated to raise a lot of revenue. So, basically, that in itself would have been about 20% of the revenue loss of the Trump plan.

Let me just describe to you what that proposal is. Starting from the system we have now, which is an income tax for corporate and noncorporate businesses and a worldwide approach to international activities, which is what Japan used to have, basically having two pieces: taxing all income generated within the country whether it be Japan and the US and then also taxing the nonresident income that is a foreign source income of resident companies. So, US resident companies pay taxes both on the income they generate in the US and elsewhere but is subject to a foreign tax credit.

While starting with that system, the proposed changes to move to a destination-based cash flow tax are really quite major. First of all, even not thinking about international provisions, it would replace depreciation deductions for capital investment with immediate expensingーthat is, immediate deductions for such investment costsーand entirely eliminate interest deductions for nonfinancial incorporation. These are very big changes even on the domestic front, in addition to the international side. First of all, ignoring foreign source income and all cross-border transactions, which are where the border adjustment comes in. Normally, a company would pay tax on its revenues from exports, deducting the costs of its imports. The border adjustments would reverse both of those tax consequences by rebating the tax on exports and denying a deduction on imports.

Now, it’s equivalent to what’s called a subtraction method. You can think about it as a value-added tax, such as the one Japan introduced not too long ago, plus a wage deduction or a payroll tax credit. That is, if one thinks of a value-added tax as taxing all value added in the business sectorーboth returns to capital and returns to laborーit would take the labor piece out and just tax the returns to capital, and the border adjustment under this system would work much the way that border adjustments work under a value-added tax.

And then you might say, well, if it bears a resemblance to a value-added tax, which it does, why did the US decide to go this way rather than moving towards a value-added tax, as Japan has done and other countries have done. This is a question with a political answer and not a very satisfying one, which is, because it’s very difficult to adopt a VAT in the United States. That is in some sense not an answer because it doesn’t explain why it’s difficult, but there has been opposition from the left and from the right, and so the value added tax has a feature which is nearly unique in American politics, which is that it unifies the left and the right in opposition to what might be a sensible proposal.

So, what’s the motivation for this proposal, and again part of the motivation is that moving to a value added tax might have made sense, but that’s generally been sort of left to decide. This is a picture that’s familiar to anybody who works in the tax policy area on the business side. What’s happened to corporate tax rates since last few decades, this goes back to 1990 with data from the OECD. I have put in the G7 countries. I have also put in the Republic of Ireland just as a sort of a benchmark to remind us what part of the problem is. And if you look at 1990, the US, which is the gray line there, actually had a relatively low corporate tax rate compared to other countries. Indeed, it had a lower tax rate than Ireland in 1990.

Since then tax rates have come down around the world, so that the US now has the highest tax rate, and of course you can see that the reduction in Ireland, but Ireland is not unique. Japan has experienced recently significant reductions. The United Kingdom has gone into a very low rate below 20%. So, the US now has a very high corporate tax rate. That sort of indicates that the US may be out of alignment and in need of reform, but it doesn’t explain why the tax rates have gone down.

To explain why that has happened, let me start with a table showing you the top US companies, 50 years ago and today. These are based on market capitalization at the time, and of course that bounces around, but if you look from year to year it doesn’t really change that much in nearby years. In 1966, familiar names even now, except perhaps for the last one, the companies that had been around like AT&T, IBM, General Motors, ExxonMobil, and Eastman Kodak. In 2016, three of the top, ExxonMobil is still there, and if you look at all the other companies, these are knowledge and intellectual property companies: Apple, Alphabet, Microsoft, Amazon. These are companies one couldn’t even have conceived of in 1966, and they are at the top. By the way, number 6 on this list is Facebook. This is just to give you an idea of the kind of companies that are populating the top ranks of the corporate sector in the United States.

Just to continue on this theme, in the last half century the share of intellectual property as measured by the Bureau of Economic Analysis in non-residential assetsーthe measure of intangible asset capital stockーhas doubled, and that’s probably an understatement. There are a lot of intellectual property assets that we don’t include when we are doing this measure. At the same time, the share of before tax profits of US companies are coming from offshore operations has quadrupled. This is according to the Bureau of Economic Analysis. These are our national accounts statisticians saying that from a very small fraction, under 10%, corporate profits of American companies coming from overseas are now over 30%.

What are the implications of this? Well, there is increased pressure on the kind of corporate tax systems that we have traditionally had. So, as I said, the US has a residence-based tax system. The residence-based tax system holds that it matters whether you are a US company or not. Now, if you are a company that only has operations in the US, you’re stuck being a US company.

But with greater multinational activity, companies that have operations around the globe, it’s hard to say that they are a US company simply because they are incorporated in the United States. They have operations everywhere. So, it’s easier to engage in corporate inversion. The reason we call these “inversions” is because they originally occurred when companies inverting their corporate structure so that the parent US companies became large underneath subsidiaries to operations that were foreign. Inversions now happen with US companies merging with foreign companies.

There is an incentive to engage in these tactics even for multinationals that might be moving to another country with relatively high taxes. This is because those countries, including Japan, won’t impose taxes on third country revenues, since their taxes are not worldwide taxesーthey are territorial taxes. There’s another problem that’s been associated with residence-based taxation and again relates to the growth of multinationals, which is the so-called lockout effect, with US companies keeping more of their profits offshore because they don’t want to bring them back and pay US taxes. So, estimates about a year ago suggested that US resident companies had $2.6 trillion of accumulated profits in offshore operations that had not been repatriated to the US because the companies didn’t want to pay tax.

There is increased pressure as well on incentives to produce in the United States. Our system taxes companies based on where they produce, so in addition to taxing US companies on their overseas profits, companies are taxed on profits generated in the United States. If you are producing in the United States, you’re being taxed on the profits generated by that production. That means if you can produce somewhere else more cheaply because of lower taxes, you are encouraged to do that. In the current business environment, where you have multinational companies that already have supply chains and operations around the world, moving production from the US to another country is more feasible. Also, because the nature of what we are producing has changed, you’re moving something that’s more feasible to move. That is, you are not putting a steel plant in a remote country where you have to spend a lot of money to ship things around; you may simply be moving intellectual property or something elseーservices or computer chipsーwhich don’t cost very much to move, and so there is more pressure on that approach to taxation.

Perhaps the most striking problem that’s gotten bigger over time is the incentive to shift profits. I am distinguishing here between shifting actual production activities from one country to another and simply using accounting transactions with related parties to move profits from one country to another. For example, Google, Apple, Microsoft, all have major operations in Ireland. And having an operation in a low-tax country, particularly if you are a company that relies on intellectual property, it’s relatively easy to engage in transactions that have the effect of shifting profits to the other country, either by overpaying for things you buy from the subsidiary or undercharging for things that you sell to the subsidiary.

In that environment, the destination-based cash flow tax is something that I have seen for many years as being perhaps the best alternative. It eliminates the ability to shift profits out of the United States because transactions across borders are ignored, so what you charge to your Irish subsidiary for a patent is irrelevant. It has no effect on your US tax liability. It eliminates incentives to shift production out of the United States because there are no taxes based on the location of production, and it eliminates incentives for corporate inversions because, as under a territorial tax system, US companies and non-US companies are treated equally by the United States and so becoming a non-US company doesn’t do anything to your US tax liability.

It also eliminates the lockout effectーthe incentive to keep profits abroadーagain, because there is no tax on repatriations. So, it struck me for a long time that this was a way of dealing with all of the problems that have been growing with the US corporate tax system. But it’s been controversial; it’s an idea that academics may have had for a long time, but people in the real world didn’t pay much attention to it. After it was introduce by key people in the House of Representatives, it became something that people paid attention to, and when people started paying attention to it, lot of them were unnerved by it. There were of course supporters as well, but there was also a concern.

On the domestic side, there was a sense of creating winners and losers. That isn’t surprising if you are undertaking a major change in the way you tax companiesーnot simply, say, having a tax cut but having a major change in taxation. You would expect that there will be winners and losers. In this case, I think there is also controversy that was in part reasonable but also due to misinformation and confusion about who the losers would be and who the winners would be and how much they would win and lose. The important industries, especially the retail industry, were very much against it from the beginning, feeling that this was going to drive their costs up substantially, reduce their profit margins, and reduce their sales.

I will just say that if one looks around the world and at the countries that have adopted value added taxes, increased value-added taxes, and moved towards consumption-based taxation, the retail industry in these countries is alive and well. But that didn’t convince the retail industry. Also, while it didn’t get as much attention, the elimination of the interest deduction would affect some industries quite significantly. That really is a big issue, and there was certainly some concern about that.

There were also repercussions or potential repercussions abroad. First of all, it would be a big step in the tax competition gameーif that is how one characterizes the efforts by countries to reduce their corporate tax rate. In this game, I lower my tax rate to try to attract business, and that pressures you to lower your corporate tax rate, and we all keep lowering our corporate tax rates, and that’s more or less what’s been going on. Well, the US, by not simply reducing its corporate tax rate but moving to a destination-based tax, would be taking a very big step in tax competition. By eliminating the deduction for borrowing in the US, it would encourage multinationals to borrow and deduct costs abroad, which would put pressure on foreign tax systems. It would encourage companies to stop shifting profits out of the US and actually start shifting profits out of other countries into the US, because that would no longer raise taxes in the US. And it would also encourage companies to shift production into the US, because they would no longer be taxed just because they produce there. So, this would put pressure on the tax systems of other countries.

Now, the issue of how other countries might respond is not clear. The EUーthe European Commission, in particularーreacted negatively to it. They have been supporting an alternative approach. The OECD had a major project that finished last year called the base erosion and profit shifting project, which was much more geared toward international cooperation to keep tax rates from going down and to keep multinationals from avoiding taxes. I am personally a skeptic of that approach, but nonetheless the European Commission presented this plan before the World Trade Organization.

There are also other international implications. Even if the plan went through, there were potential disruptions in credit markets abroad. If the dollar appreciated, as was predicted, sovereign borrowers or private borrowers and countries with unstable currencies that had borrowed in dollars rather than in their home currency might be adversely affected, as would be the case whenever the dollar appreciates.

Now, what’s the outlook for US tax reform? Well, this is a fast moving process that resulted in a statement that came on July 27. There has been a so-called Group of Six negotiations going on consisting of six people: Paul Ryan, the speaker of the House; Mitch McConnell, the majority leader in the Senate; Steve Mnuchin, who is the treasury secretary; Gary Cohn, who is the head of the National Economic Council; Orin Hatch, who is the head of the Senate Finance Committee, the tax-writing committee in the Senate; and Kevin Brady, who is the head of the Ways and Means Committee in the House of Representatives.

I should add that Mnuchin and Cohn are essentially the only two economic policy people in the executive branch right now. There are huge vacancies at the US Treasury. There is no appointed tax staff at the Treasury right now, just career staff. There is no Council of Economic Advisers. So, these individualsーMnuchin and Cohnーwho are negotiating on behalf of the administration are essentially doing it without the kind of support and professional advice that they would normally be receiving from career staff and senior appointed staff. Anyway, they came out with their proposal, which is a little bit akin to the Trump proposal. It is more than one page. It’s actually about a page and a quarter. So, we are making progress. It proposed lower tax rates for small and large businesses, which was a carryover from both the Trump plan and the House Blueprint. Investment expensing is also a carryover. But even though they had discussed the border adjustment and clearly heard arguments about its meritsーbecause Ryan and Brady are the two biggest supporters and proponentsーit didn’t say anything about the tax or interest deductibility, which was the other big source of revenue in the original plan. It just had a bunch of statements about what they were going to accomplish without saying what the instruments would be to accomplish those things. And of course it would be great to be able to accomplish all these things and bring back jobs and profits trapped overseas, which suggests getting rid of the lockout effect and getting rid of incentives to shift productionーtwo of the things that I indicated the destination based cash flow tax would accomplish and level the playing field between American and foreign companies and workers. It’s not clear what the means would be, but presumably there would be a lower tax on US activity than at present. And then finally, the plan calls for protecting American jobs and the US tax base, but it’s not exactly clear what that means.

Now, just a reality check. Many economists are not surprised by the healthcare debacle that just happened because the people who are trying to accomplish reform stated a bunch of objectives that they intended to accomplish. They intended not to cut the cost of providing healthcare to lower the premiums that people had to pay for their healthcare and to not reduce the number of people getting health insurance. And it didn’t take much to know that this was impossible. People were surprised as the process went on that whenever there would be news of a particular proposal, they learned that there would be fewer people having health insurance, but this was no surprise to anybody who had even the slightest understanding of how the healthcare system works in the United States.

I have a similar reaction to this tax reform plan. Without the border adjustment, which you will recall raises a substantial amount of money, you also need to have a low tax rate to compete. One of the things border adjustments would do would be to make reducing the corporate and business tax rate less important because you don’t really need to lower the tax rate once you have shifted to a destination-based tax, any more than you would say have to have a low value added tax rate to encourage businesses to operate in your country. But without a border adjustment to accomplish these various objectives, you do need a very low or much lower corporate tax rate than we currently have.

If we lower the corporate tax rates substantially without border adjustment, and there is no plan to reduce interest deductions, instead keeping the expensing of investment, there is going to be a huge loss in tax revenue.

Now, one possible outcome is just to have a big tax cut. That wasn’t the original plan, but that is certainly something that can happen. And here we have to pretend we’re parliamentarians again and ask what that does, and one of the things that does in the US is that any tax cut passed must be limited to 10 years, or whatever the budget planning period happens to be. This was true of the last tax cut we had, the big tax cut in 2001. When George W. Bush came into office, he proposed, and Congress passed, a big tax cut. Because it was a deficit-increasing tax cut, it was required to last only 10 years, and we then spent a lot of time in the Bush and Obama administrations having quarrels about whether to extend the Bush tax cuts and what to do about it. Ultimately, in the middle of the Obama administration, there was a permanent resolution. So, we may end up having something like that.

And on the last point of what the plan wanted to doーprotect jobsーgiven the current administration, that sounds a lot like tariffs. I don’t know whether that’s part of their tax plan, but I wouldn’t rule it out.

So, what does all this mean? Well, it’s certainly possible that little will be accomplished in the short term. If we use the healthcare example as an indicator, it’s hard to rule that outcome out. The president said of the healthcare process, “Who knew healthcare was so complicated?” He is likely to say that about tax reform at some point in the coming weeks as tax reform is discussed, and this may foreshadow an outcome like that we had for healthcare, which is no progress.

One possibility is that tax reform, unlike Obamacare, which Republicans felt they just had to deal with right away, could be dealt with later, say, next year. Another issue that has to be considered is that we have congressional elections every two years, and in 2018 all members of the House of Representatives will be standing for election and one-third of the members of the Senate. And it is certainly possible that control of both houses would be at risk for the Republicans, and they will need to be thinking hard about what they want to do in an election year.

The common wisdom is it’s hard to pass significant legislation in election years, and that is one of the reasons why there was such a push to accomplish things this year. It’s why the Bush tax cuts were adopted in 2001. It’s why President Clinton introduced tax increases in 1993 just after his election. It is why Obamacare was introducedーultimately passed only in 2010 but was introduced earlierーeven during a terrible recession. New presidents try to accomplish things in their first year for good reason, and so it’s quite possible that if tax reform doesn’t happen this year, it won’t happen next year either. And that may not be a bad thing. Given the constraints that have been put on the process, it’s hard to believe that a sensible outcome will occur if Congress acts quickly this year, unless they decide to go back on some of the elements of the one-and-a-quarter page document that they have introduced so far.