Rumors abound that the consumption tax hike, scheduled for October 2019, will be postponed a third time, despite repeated assurances to the contrary by the administration. Looking at IMF growth projections, Senior Fellow Takero Doi examines whether economic conditions warrant yet another deferral.

* * *

The fiscal 2019 budget that the Diet enacted on March 29 is premised on the consumption tax being hiked as planned in October. It also includes stimulus measures to prop up demand after the tax is raised from 8% to 10%.

With the start of the new fiscal year on April 1, 2019, all contracts for transactions involving the provision of products or services on October 1 or later are required by law to cite the new standard rate of 10% (except for items like food, beverages, and newspapers, for which a "reduced rate" of 8% will continue to apply). A six-month leeway is mandatory as an interim measure before the new rate comes into effect.

Some observers, though, suspect that Prime Minister Shinzo Abe may—for the third time—postpone the hike, pointing to developments that are likely to dampen global economic growth, such as the evolving trade war between Washington and Beijing and Britain’s exit from the European Union. But any decision that comes after April 1 will force businesses to conclude new contracts for post-October transactions, inviting considerable market confusion. A new bill to cancel the October 1 tax hike would have be deliberated and passed in both houses of the Diet, which will require a minimum of two to three weeks. Transactions during that span would stagnate due to uncertainty about the rate for the date that a product or service is delivered. From a practical viewpoint, a postponement at this stage is unrealistic.

Incidentally, Prime Minister Abe’s two earlier announcements came more than six months before the scheduled increase. He called for putting off the October 2015 hike in November 2014, and his decision to again delay the April 2017 increase was made in June 2016. He is apparently aware of the need for a six-month transition period in setting a new consumption tax rate.

A number of commentators continue to stoke fears, though, that raising the tax as scheduled in October would trigger a global recession of the same magnitude as the global financial crisis. Indeed, the International Monetary Fund in April 2019 issued its updated World Economic Outlook, in which it downwardly revised the forecast for real global growth that it announced in January.

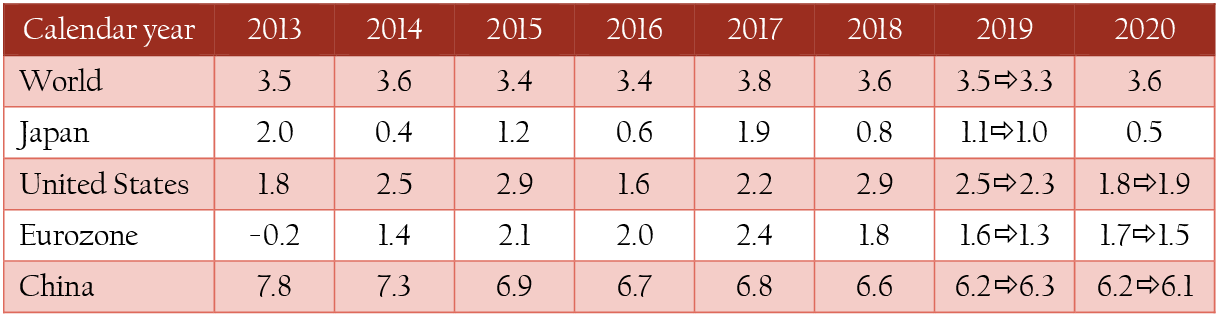

The April 9 revisions, outlined in the table below for major economies, touched off a wave of pessimism in stock markets around the world.

Real Growth of Major Countries, Actual and Projected

Source: International Monetary Fund, World Economic Outlook (arrows indicate projections revised between January and April 2019).

An Expanding Economy

As the table indicates, projected growth in real terms for the world as a whole in 2019 was downwardly revised from the January forecast of 3.5% to 3.3%—the lowest forecast since 2010. The factors behind the IMF decision included higher tariffs that were likely to dampen trade and result in slower growth in the major economies. China’s growth, though, was upwardly revised to reflect additional stimulus spending by Beijing.

IMF economists downwardly revised Japan’s real growth in 2019 by 0.1 point, citing the expected hike in the consumption tax. Other economies, too, were forecast to sputter to their lowest growth since the 2008 global financial crisis. That said, Japan’s 2019 forecast, at 1.0%, was still higher than the 0.8% the economy registered in 2018. The main factor behind the comparatively sanguine projection was the approximately 2 trillion in fiscal stimulus earmarked in the fiscal 2019 budget to offset the adverse impact of a higher tax.

The latest budget is premised on there being a higher tax in October and includes stimulus spending to mitigate its negative impact. The IMF outlook, too, anticipates both of these measures being implemented as scheduled.

The IMF expects slightly higher real growth in 2019 than in 2018, even if the consumption tax is raised as scheduled. It does not see the economy as being in recession nor does it foresee Japan triggering a global economic crisis. If the economy is expanding, albeit at a sluggish pace, it should be difficult to justify yet another postponement of a hike in the consumption tax.

The IMF’s revised forecast of 3.3% growth for the global economy, incidentally, is the same as that announced in October 2014 for calendar year 2014, when growth actually reached 3.6%, as shown in the table above.

The key to preventing another global financial crisis is maintaining financial stability in China—not delaying a tax hike in Japan. Japan and many Western economies have adopted reform measures designed to prevent a recurrence of earlier crises, including the Asian financial crisis of 1997, so a global financial meltdown is now less likely to emanate from these countries. China, on the other hand, was not significantly affected by the earlier crises and might be less prepared to deal with an emergency.

A global economic downturn on the scale of the Great Recession is unlikely to occur without a massive financial crisis. The IMF outlook compellingly suggests that a tax increase in a single country will not generate such a crisis.