- Article

- Macroeconomics, Economic Policy

Is Population Decline a Constraint on Economic Vitality?

August 6, 2019

What can Japan learn from the policies of the Heisei era? On April 18, 2019, on the threshold of a new imperial era, the Tokyo Foundation for Policy Research held a public symposium to review the outcomes of three decades of fiscal and tax policy and their implications for the future. In his keynote presentation, economist Hiroshi Yoshikawa draws on historical trends to identify the key challenges going forward.

* * *

The population of Japan is aging and shrinking, and the economic and social challenges posed by these trends are very real. But population is not destiny. I think it is important to put the issue of population decline in perspective by considering, among other things, how very recently it emerged as a focus of concern.

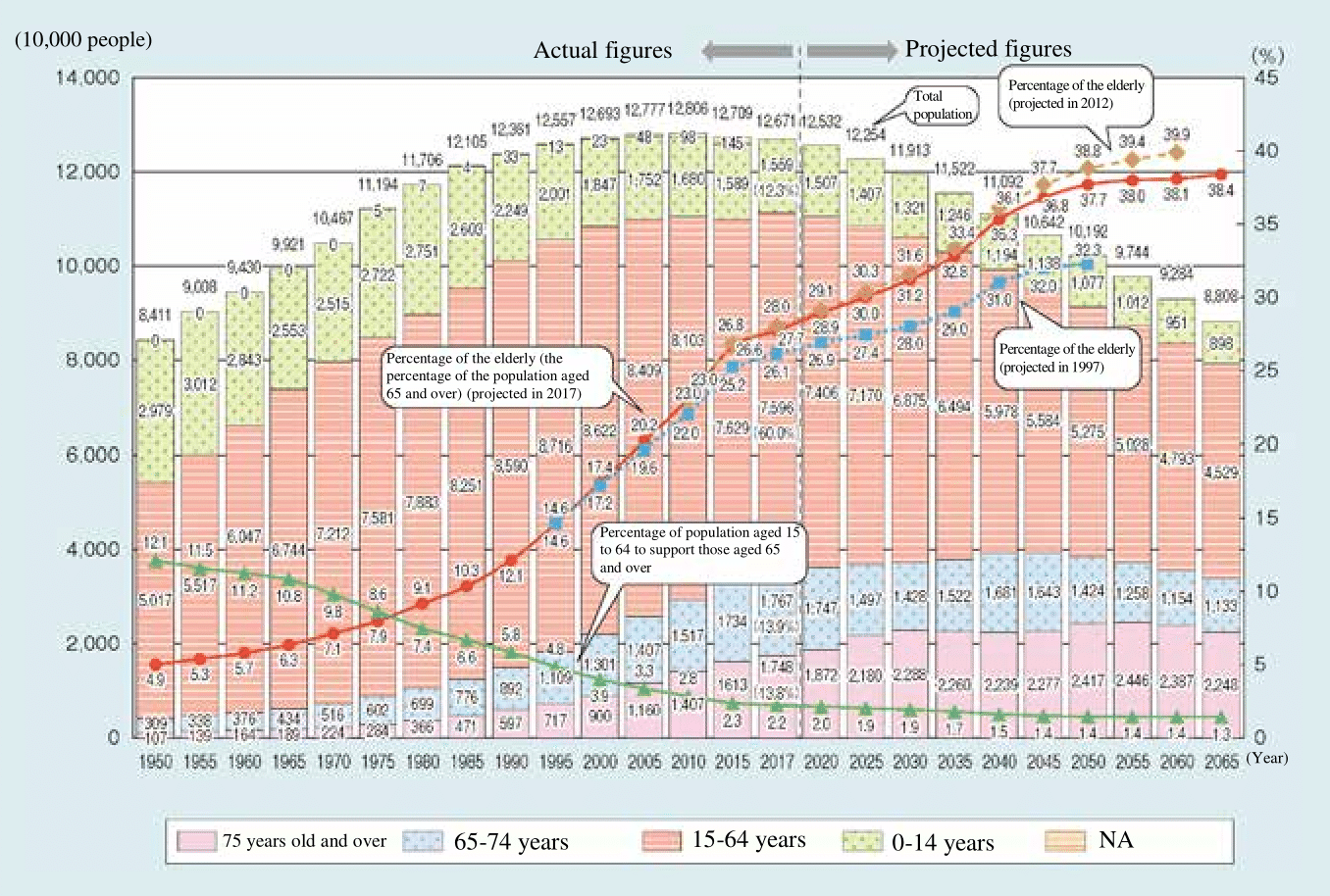

As of April 2019, Japan’s population stood at about 120 million. By 2115, it will plunge to about 50 million, according to the medium-variant population projections published by the National Institute of Population and Social Security Research (IPSS) in 2017. In other words, over the next century, the Japanese population will shrink by almost 60%, losing the 70 million that it has gained in the century since 1919.

A demographic change of this magnitude will certainly have an impact on our society and economy. But it is worth recalling what a new issue this is for Japan. Until quite recently, Japan’s main demographic challenge was overpopulation.

During the Meiji era (1868–1912), the population grew so rapidly that the Japanese government became alarmed and began actively encouraging emigration as one answer to the threat of overpopulation.

Seishiro Itagaki, the senior Imperial Army officer who helped stage the 1931 incident leading to Japan’s seizure of northeastern China, believed that Japan needed to expand into Manchuria, in part to avert an overpopulation of the Japanese archipelago. Expansion, he felt, was the only way to resolve the dilemma of a rapidly expanding nation squeezed into a small territory with limited natural resources.

Overpopulation remained a major concern after World War II. In the wake of the 1947–49 baby boom, policy experts were preoccupied with the challenge of feeding and housing the country’s rapidly growing population. For many years, the basic orientation was toward population control. The most deplorable product of that mindset was the forced sterilizations carried out under the Eugenic Protection Law of 1948 (repealed in 1996).

I remember learning about Japan’s “population problem” in elementary school, back in the early 1960s. In our social studies textbook, Japan was ranked among the two or three most densely populated industrialized countries, along with Belgium and the Netherlands. It left me with the sense that our country was just too crowded to function properly.

In respect to demographic aging, some concerns emerged as far back as the 1970s. Prime Minister Kakuei Tanaka had just introduced free medical care for the elderly, and a few farsighted population scientists and government officials began questioning the long-term sustainability of Japan’s healthcare system. But it remained an esoteric topic confined to a small circle of experts.

Beginning in the mid-1970s, Japan’s fertility rate plunged below the replacement level. The trend continued through the 1980s, the “Japan as number one” decade. In the early 1990s, the asset bubble collapsed, and economic growth ground to a halt, but even then no one was sounding the alarm about population decline. To the contrary, Japanese corporations were struggling to shed superfluous employees and shrink their payrolls.

During the administration of Prime Minister Jun’ichiro Koizumi (2001–6), I served as an independent expert on the government’s public-private Council on Economic and Fiscal Policy. By that time, the graying of Japanese society and the impact on the social security system were major topics of discussion, but few believed that the decline in the productive population boded ill for future economic growth. It has really only been in the past 10 years that people have begun spotlighting population decline as a constraint on economic vitality.

Of course, the low birthrate and the rapid aging of our population structure will create serious challenges for Japan going forward. Among the biggest concerns are the burden of rising social security costs and the collapse of regional communities as a result of depopulation. But to blame economic stagnation on population decline is a mistake, as I hope to demonstrate.

Inequality in an Aging Society

As Emperor Akihito noted in December last year, in one of his final statements before abdicating the throne, the Heisei era was a time of genuine peace for Japan, and for that we should all be grateful. The same cannot be said of the three previous eras in modern Japanese history (Meiji, Taisho, and Showa). Unfortunately, the three decades of Heisei were also a period of widespread and mounting dissatisfaction with the economic status quo.

What is behind this frustration? I think one important factor is the widening gap between rich and poor. Although this is also a problem at the global level, here I am referring to growing income inequality within our industrially advanced society—a problem occurring throughout the developed world. The French economist Thomas Piketty helped draw attention to this phenomenon with his book Capital in the Twenty-First Century (2013). While some economists have since criticized Piketty’s work as theoretically flawed, I believe he has done a great service by spotlighting the trend and its consequences.

The problem of income inequality is particularly conspicuous in the United States, where the disparities were larger to start with and have grown even more pronounced in recent years. It is not hard to see why someone like Vermont Senator Bernie Sanders would capture the support of voters with his call for policies to redress economic inequity. But economic discontent is also creating problems in Europe, where high unemployment among the young is fueling social and political unrest.

In Japan as well, the Gini coefficient—a widely accepted measure of economic inequality—is on the rise. And demographic aging is one factor contributing to the trend. The reason is simply that disparities in wealth tend to be more pronounced among the elderly than among younger age groups. Consequently, as the elderly occupy a larger share of the population, economic inequality increases in society as a whole. At present, about 45% of the 2 million Japanese citizens on taxpayer-supported public assistance—the final social safety net—are 65 or older.

Figure 1. Trends in Population Aging and Future Projections

Source: Cabinet Office, “Annual Report on the Ageing Society: 2018.”

When the Koizumi cabinet was pursuing reform of the social security system, it argued that being elderly does not always equate to being socially vulnerable. I agree with that as far as it goes. But the fact remains that a relatively large proportion of seniors are at risk of slipping into poverty. Rising poverty rates have been another consequence of the graying of Japanese society.

Mencius said, “Old men without wives are called widowers; old women without husbands are called widows; the elderly without children are called desolates; the young without parents are called orphans—these four, the most destitute and voiceless among the people, King Wen made his first concern, displaying humaneness in his conduct of government.”* This was an early admonition to rulers to protect the vulnerable—the fourth-century Chinese version of social security.

Another major factor contributing to the growth of income inequality in Japan has been economic stagnation. During these past 25 years of slow growth, income disparities have widened among working-age people, particularly between regular and nonregular employees. Nonregular employees accounted for just 16%–17% of the labor force in 1989, at the start of the Heisei era. Now they make up 40% of the total. The ramifications have been profound.

The phenomenon has taken a toll particularly on men currently in their late thirties through mid-forties. This age group represents the “baby boomlet,” the echo of the original postwar baby boom. Initially it was hoped that these children of the baby boomers would produce enough offspring themselves to slow the pace of demographic aging, but those hopes were dashed. Men of this generation graduated and entered the job market during the lean post-bubble years, when the big corporations cut back on or froze hiring of permanent employees. As a result, a relatively large number were obliged to settle for contract employment. Since such jobs generally mean lower pay and less financial security, this affected their marriageability and capacity to build a family.

For all the talk about the need to boost the fertility rate to stem the population implosion, this is the reality of life in Japan today. Something is amiss in our society as a whole.

The Crucial Role of Social Security

As we have seen, income inequality has increased substantially over the past 20 or 30 years. But economic polarization is not a new problem; to the contrary, it has plagued capitalist society from its beginnings.

Capitalism as we know it appeared in England in the mid-eighteeenth century, around the same time as the Industrial Revolution. During the nineteenth century it spread to other parts of Europe and, eventually, to Japan. By the mid-eighteenth century, Karl Marx and Friedrich Engels were already grappling with the fundamental problem of growing inequality in capitalist society. In the Communist Manifesto (1848), they argued that the capitalist system was fundamentally flawed in that it led to the progressive concentration of wealth in the hands of a few capitalists who controlled the means of production, while the workers slaved away without ever getting ahead. They called for a proletarian revolution leading to the establishment of a socialist—and ultimately communist—society.

As it turned out, none of the world’s industrial countries heeded this call. To be sure, the 1917 Russian Revolution toppled the tsarist autocracy and gave rise to the world’s first socialist state (an accident of history in many ways), but tsarist Russia was not an industrial country. The developed countries of the West all continued to adhere to the system of free-market capitalism. At the same time, they recognized that something had to be done to check the ongoing concentration of wealth.

Social security (in the broadest sense) was meant to serve as a kind of breakwater against the forces of economic polarization. It was German Chancellor Otto von Bismarck who introduced the world’s first public health insurance system.

In late-nineteenth-century Britain, the Fabian Society, led by Sidney James Webb among others, emerged as a highly influential force for democratic socialism. The movement attracted many distinguished intellectuals of the day, including George Bernard Shaw and H.G. Wells. In 1895, at a time when only the scions of the rich were able to attend Oxford and Cambridge, Webb, Shaw, and others founded the London School of Economics as a center for Fabianism and an institution of higher education open to all. Fabianism influenced the thinking of such noted British economists as William Henry Beveridge—who served as director of the LSE—and John Maynard Keynes.

During World War II, the cabinet of Prime Minister Winston Churchill set up a commission, chaired by the Fabian socialist William Beveridge, to design a comprehensive social insurance system. This speaks to the pervasive influence of Fabianism, inasmuch as Churchill was the leader of the Conservative Party. The report issued by the committee in 1942, commonly known as the Beveridge Report, provided a blueprint for “cradle to grave” social security. Ironically, the Conservatives lost the 1945 general election, and it fell to the Labour Party to construct the new welfare system following that blueprint. The central achievement of the plan was the National Health Service, which, since its establishment in 1948, has been funded almost entirely by taxes.

Sweden, meanwhile, has forged its own path as the welfare state par excellence. It has also produced more than its share of distinguished economists, including Knut Wicksell, Eli Heckscher, Bertil Ohlin, and Gunnar Myrdal. Beginning in the 1930s, Myrdal collaborated with his wife, Alva Myrdal, in the development of a number of influential social policies, including family policies credited with boosting the nation’s fertility rate at a time when other Western European nations (like Japan today) were much preoccupied with the specter of population decline. Throughout history, childcare had been viewed as the exclusive domain of the family. The Myrdals argued that, with more and more urban wives working outside the home, society needed to step up and provide support. Ninety years later, Japan is still struggling with this realization.

Why Is Income Inequality a Problem?

Just how big a problem is income inequality?

Pre-revolutionary Russia enjoyed remarkable growth in gross domestic product near the end of the nineteenth century, under Tsar Nicholas II. But the massive disparities in wealth stoked discontent, and government efforts to quell the social unrest only made things worse. This vicious circle, compounded by the impact of World War I, ultimately led to the 1917 Revolution.

In the late 1970s, under Shah Mohammad Reza Pahlavi, Iran was receiving glowing economic reports from the International Monetary Fund. But as its wealth increased, so did the gap between rich and poor, which—in combination with opposition from religious conservatives—made the country ripe for revolution. In 1979, the shah fled the country, and Ayatollah Ruhollah Khomeini swept into power.

These are just two instances of how economic inequality beyond a certain threshold can throw a society into turmoil even when the economy as a whole is growing rapidly. In other words, the simple answer to the question “How big a problem is economic inequality?” is “Big enough to overthrow the social order.” A large, thriving middle class is one of the keys to social stability. In this sense, economic polarization is a serious problem indeed.

The next question is, “What is to be done about it?”

Toward a Sustainable Social Security System

Economic inequality will never be eliminated entirely. But we can design policies to help stem the kind of extreme polarization that can destabilize a society. Social security is a key component of any such policy.

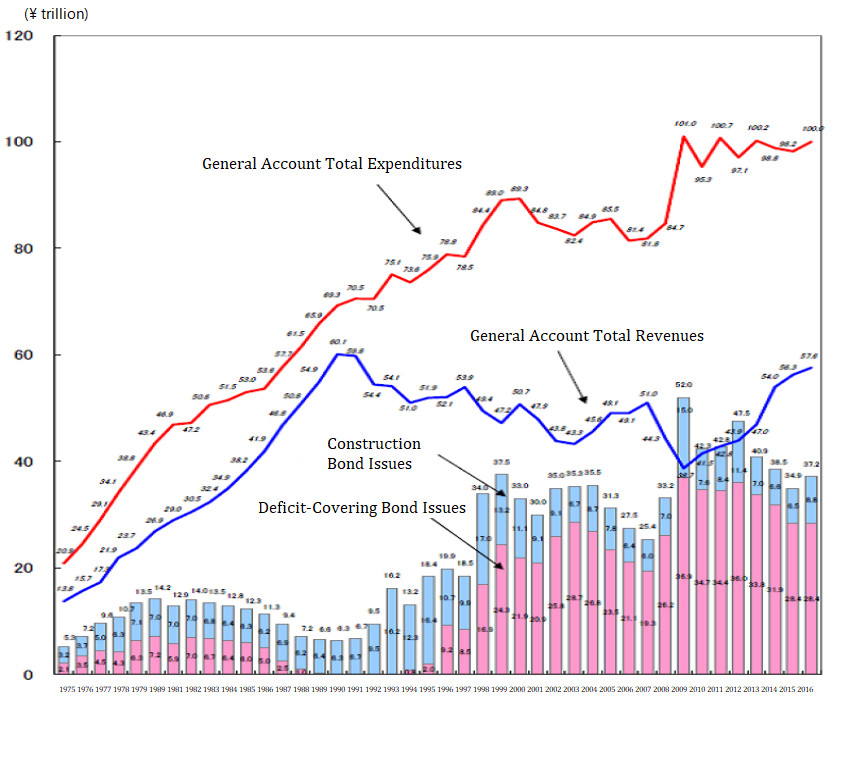

Here in Japan, this leads us to a dilemma. Social security benefits currently amount to more than ¥110 trillion a year. Social insurance premiums account for just ¥66 trillion of that; the rest is covered by public outlays—¥32 trillion from the central government and ¥13 trillion from local coffers. This spending is the biggest source of Japan’s massive budget deficits. This is not a sustainable state of affairs.

The cabinet of Prime Minister Shinzo Abe has placed top priority on spurring economic growth, arguing that expansion is vital if we are to reduce the budget deficit. Growth may be a necessary condition for reducing the deficit, but it is not a sufficient one. We will need to do more than encourage economic expansion if we are to put government finances on a sustainable footing. We will also need to raise taxes.

Back in 2005 and 2006, during the final months of the Koizumi cabinet, some experts were already making this argument. But their voices were drowned out by the so-called ageshio (rising tide) camp, which maintained that a combination of growth spurred by deregulation and cuts in government spending could balance the budget without tax hikes. The most prominent advocates of this approach were Heizo Takenaka (then minister of internal affairs and communications), Hidenao Nakagawa (then chair of the Liberal Democratic Party General Council), and Shinzo Abe (then chief cabinet secretary). It appears that Abe’s faith in economic growth is deeply rooted.

Unfortunately, it is also misguided. Economic growth is important, but it is folly to imagine that we can balance the budget through natural increases in tax revenue alone. As for wasteful spending, the government has been cutting programs ever since the Koizumi years. The only area of the budget that has been growing, apart from debt service, is social security.

Figure 2. Government Expenditures and Revenues

Source: Ministry of Finance statistics.

Economic Growth in an Aging Society

I would like to conclude with some remarks on economic growth and population.

There is no question that Japanese society is facing new challenges posed by an aging and dwindling population. But the idea that population decline means a loss of economic vitality is seriously mistaken.

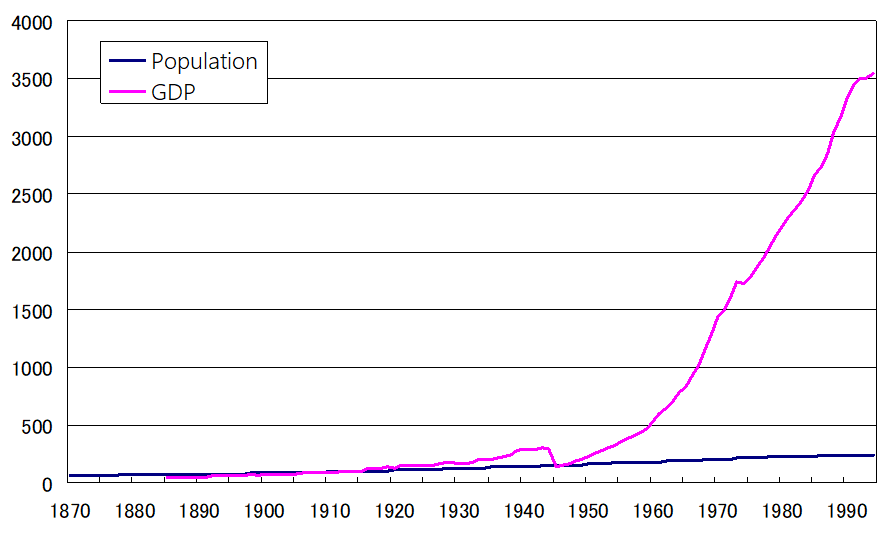

The figure below compares population and GDP growth, indexed to the year 1913, from 1870 to 1994 (1913 = 100). The two trend lines reveal almost no correlation. The gap between population growth and economic expansion—particularly conspicuous after World War II—is a function of rising labor productivity. And the rise in labor productivity roughly corresponds to growth in per capita income. As long as the average output per worker increases, the economy will grow even without any additional labor input.

Figure 3. Population and Economic Growth in Japan, 1870–1994 (indexed to 1913)

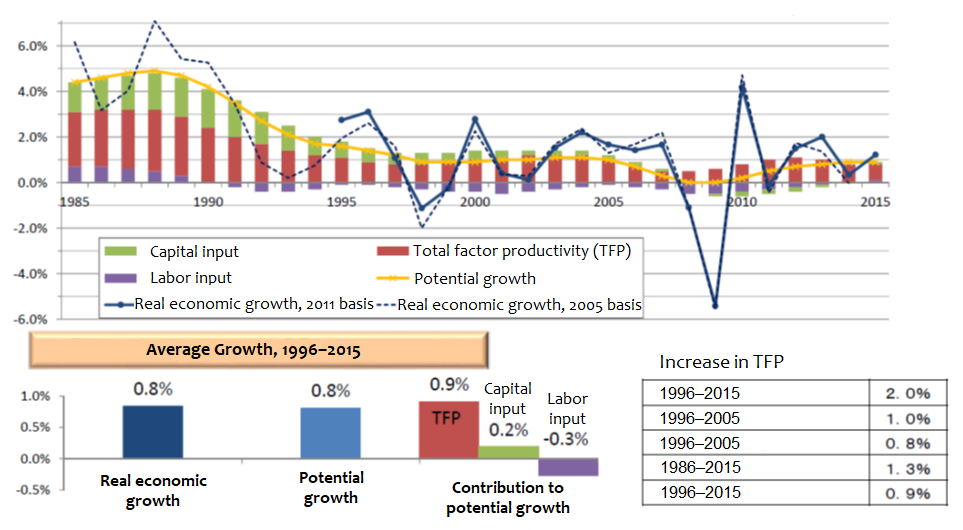

To be sure, the chart stops well before we enter the era of population decline. But we can get a sense of recent trends through “growth accounting” for the period from 1996 to 2015 (see Figure 4). Growth accounting is a technique for measuring the contributions of capital input, labor input, and total factor productivity (TFP)—a reflection of technological progress—to real GDP growth.

Between 1996 and 2015, annual GDP growth in Japan averaged 0.8% (notwithstanding the impact of the global financial crisis and the 2011 Tohoku earthquake and tsunami). The contribution of capital input was 0.2%, while that of TFP was 0.9%. The contribution of labor input, meanwhile, was –0.3%, owing to the decline in the working-age population. Nonetheless, thanks to the 0.9% increase in TFP, total output grew at an average annual rate of 0.8%. Moreover, the growth of real per capita GDP—factoring in the drop in population—comes to more than 1%. This translates into an increase in per capita income, which fuels further economic growth. Growth in per capita income is much more pertinent to a nation’s economic health and vitality than the growth of its population, and this principle remains operative even when the population is contracting.

Figure 4. Factors Contributing to Real and Potential Growth, 1996–2015

Source: Reproduced from materials distributed at a meeting of the Social Security Council’s Pension Committee, October 6, 2017.

Innovation Fuels Growth

Japan is not the only developed country with a shrinking population. Germany’s rate of population decline approaches that of Japan. At a conference in Berlin several years ago, I discussed demographic and economic issues with a group of German business leaders, government officials, and economists. I asked one expert if he felt confident about the future of Germany’s economy, given the decline in the nation’s population. This is what he told me: “I don’t believe that a shrinking population is incompatible with economic growth. The main thing is growth in per capita income. That comes from innovation. Germany is one of the world’s most innovative countries. We have a strong economy, and I believe that we can make it even stronger through the power of technology and innovation.”

This is the kind of thinking that Japan should embrace. If we want to regain our economic vitality, we need to invest in innovative technology. Yet Japan’s corporations continue to build stockpiles of cash. The business sector accounts for the largest share of Japan’s savings surplus. Joseph Schumpeter would no doubt have exhorted them to invest in R&D to drive innovation and economic growth.

Herein lies the real cause of Japan’s lackluster economic performance during the Heisei era. Of course, depopulation and demographic aging pose challenges for the economy. But to assume that the economy will contract along with the population is fatalistic in the extreme. Instead of resigning ourselves to economic stagnation, we need to focus on corporate innovation as the key to labor productivity and per capita growth.

*Mencius, translated by Irene Bloom (New York: Columbia University Press, 2009), p. 19.