- Article

- Industry, Business, Technology

The Role of Financial Institutions in Sustainable Growth: Lessons from the Development Bank of Japan

November 26, 2019

The Sustainable Development Goals cannot be achieved by government action alone. They demand a concerted, coordinated effort by the public, private, and social sectors. As members of society and partners in this effort, companies have begun incorporating the principle of sustainable development—of their own business and of society as a whole—into their management strategies, taking the concept of corporate social responsibility to a new level. This includes new commercial undertakings aimed at addressing environmental and social challenges using their products, technology, and know-how.

The financial sector has a key role to play in support of this trend. By channeling capital to companies that pursue sustainable management, players in the financial markets can encourage companies to “create shared value,” balancing business profits with long-term social and environmental benefits. Major financial institutions have recently expressed their support for the Task Force on Climate-related Financial Disclosures (TCFD), a decision that will help them identify those companies with environmentally sustainable practices.

In the realm of direct finance, institutional investors, such as pension funds, have begun applying environmental, social, and governance criteria to their investment decisions. ESG investing (also known as socially responsible investing) is on the rise, but its reach is limited. In the following, I discuss the mechanism and limitations of ESG investing and consider how banks and other financial intermediaries can apply similar principles so as to accelerate the flow of capital to sustainable business activity. As an example, I focus on the Development Bank of Japan (DBJ) and its pioneering Environmentally Rated Loan Program.

The Rise of ESG Investing

As ESG investing impacts the flow of international capital, more and more companies are engaging in and publicizing CSR activities in hopes of attracting ESG investors. Institutional investors, meanwhile, are continuously improving the decision-making process behind their ESG investing and engaging with the management of investee companies to encourage and support CSR. In this way, ESG investing has emerged as an increasingly important tool for the mitigation of environmental and social problems.

Governments have traditionally used regulation as a means of direct intervention to shift such negative externalities as environmental pollution back to the businesses that generate them. A second approach, which has come into focus as a way to control mobile-source pollution, is the use of such economic tools as environmental taxes and emissions credits. A third strategy, advanced by US economist and environmentalist Tom Tietenberg, is to leverage the power of corporate disclosure.[1] The reasoning is that if companies are provided with reporting guidelines and called on to disclose their own environmental burden and their efforts to reduce it, they will voluntarily adopt environmentally friendly policies as a matter of accountability to their stakeholders.

But a further incentive for taking voluntary action is to maximize corporate value over the long term. For example, businesses may voluntarily reduce their environmental impact in order to avoid direct government intervention in the form of regulation or taxes, which would cost them in the long run.

ESG investing strengthens the links between voluntary environmental action, disclosure, and long-term corporate value. With the help of ratings based on objective indicators, investors can use companies’ environmental performance as a basis for investment decisions, facilitating the flow of investment funds to environmentally friendly businesses.

Overcoming the Limits of ESG Investing

ESG does have its limitations, however. One is the fact that it is by nature limited to publicly traded companies. We need to remind ourselves that local businesses and other small and medium-sized enterprises are key players in the economy and a vital part of the effort to build a sustainable society. Indeed, smaller businesses often distinguish themselves with the kind of innovative technology and visionary, far-sighted management that make for outstanding CSR. But if they are not publicly traded, they are generally outside the scope of ESG investing.

This is where indirect financing comes in. Investment capital can find its way to unlisted companies through the medium of bank lending. And banks can use their screening and risk-assessment capabilities to support socially responsible, sustainable businesses. In Japan, where a relatively large proportion of capital is raised through indirect financing, banks exert a powerful influence over their wide-ranging clientele and, by extension, over society as a whole. In addition to disseminating and promoting the principles of socially responsible management, banks can actively support businesses in their application of those principles. This kind of “ESG financing” (or “sustainable financing”) can contribute materially to the resolution of social and environmental issues as a complement to ESG investing.

In the following, we will look at the DBJ’s Environmentally Rated Loan Program as a pioneering example of ESG financing.

The DBJ Environmentally Rated Loan Program

Overview

The general term for lending tied to environmental goals or outcomes is “green financing.” Small-scale green financing has been around for some time in the form of personal “eco loans” offered to qualified borrowers—generally individuals—for such purposes as installing solar energy panels, purchasing an energy-efficient home, or buying an electric car.

In the realm of business loans, a limited amount of green financing was previously available in the form of low-interest loans to companies certified as compliant with the international environmental-management standard ISO 14001. However, the DBJ’s Environmentally Rated Loan Program, launched in 2004, was the first business loan program to link lending decisions and interest rates to companies’ overall environmental rating. Since then, this approach has been embraced by other lending institutions as well.

The DBJ subsequently instituted two other lending programs that make use of sustainability ratings: the DBJ BCM Rated Loan Program, which scores companies on their disaster risk reduction and business continuity plans (launched in 2006) and the DBJ Employees’ Health Management Rated Loan Program (launched in 2012). Through these three sustainability-based “certification programs,” the DBJ uses the lever of indirect finance to promote key components of CSR management in the business community.[2]

Figure 1. DBJ Certification Programs

Source: Development Bank of Japan, https://www.dbj-sustainability-rating.jp/en/about/outline.html.

History

The Development Bank of Japan was established in October 1999 in a merger between the Japan Development Bank and the Hokkaido-Tohoku Development Finance Corporation to finance business undertakings beneficial to Japanese society—in other words, projects that address social needs and issues in accordance with government policy. In October 2008, the bank was reconstituted as a joint-stock corporation, but its basic purpose of addressing social needs and issues remains unchanged.

From the beginning, the DBJ has placed high priority on the environment. In June 2001, it became the first Japanese bank to join the UN Environmental Programme Financial Initiative by signing the UNEP Statement of Commitment by Financial Institutions on Sustainable Development. The UNEP FI Statement, as it is known, is a pledge by banks and other financial institutions to work with the UNEP on environmental issues and integrate environmental concerns into their business decisions and practices to promote economic development that is compatible with a sustainable, healthy environment. In October 2003, the DBJ co-organized the 2003 Global Roundtable in Tokyo, the first UNEP FI roundtable held in Asia. The Tokyo Principles released at the roundtable called for the development of financial instruments that contribute to environmental conservation and sustainable development. The DBJ led the way with the development of the Environmentally Rated Loan Program, launched in 2004.

The ERLP broke new ground in green financing by expanding the scope of screening from the individual project to the applicant’s overall environmental performance. It built a system that applies the basic principles of socially responsible investing—that is, the use of such sustainability criteria as environmental risk alongside traditional financial criteria—to indirect finance. To this end, it developed its own quantitative assessment and rating system, taking into account the environmental impacts of the company’s operations, as well as the positive contribution of its sustainability initiatives, in each area of business. This system not only enabled the DBJ to make a fair assessment of businesses’ environmental risk but also helped the DBJ strengthen its own environmental risk management and laid the foundation for other financial products designed to promote CSR—including the BCM and Employee Health programs.

Process

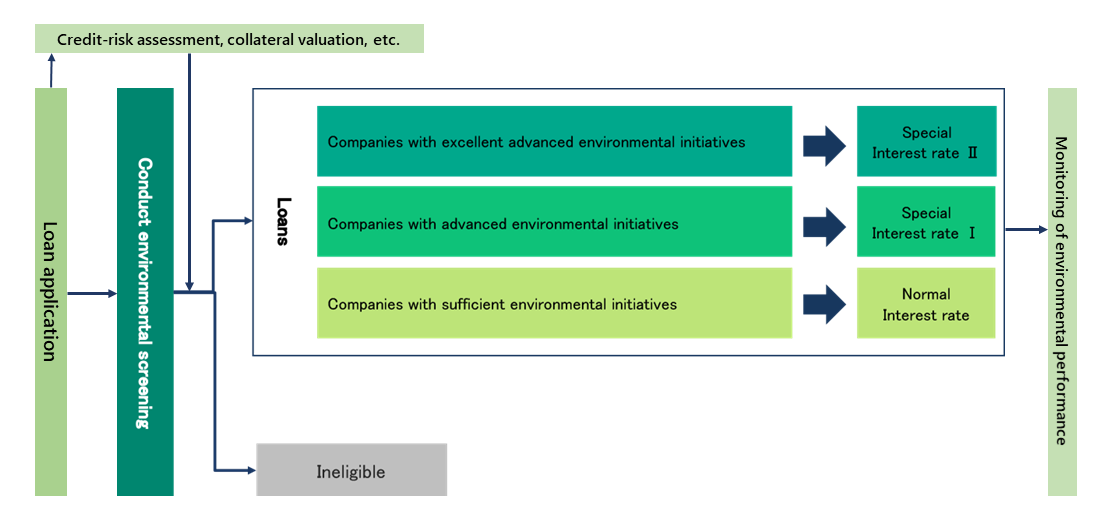

The system used in processing loans under the Environmentally Rated Loan Program is outlined in Figure 2. When the DBJ receives an application, it carries out an environmental assessment (or “screening”) of the company applying for the loan. The environmental assessment is broadly divided into two parts, “environmental management” and “sustainability.”

The environmental-management portion consists of 120 assessment items pertaining to the company’s internal environmental management system; its products, policies, and practices across the supply chain; and a wide range of data to measure environmental outcomes. In keeping with recent trends, this assessment, which includes both qualitative and quantitative components, takes into account not only risk factors but also the positive impact of efforts aimed at harmonizing the imperatives of sustainable development with those of business growth.

The sustainability portion of the assessment has a long-term focus and consists of 30 items covering such sustainable-management topics as identification of material issues, strategies, and performance indicators. The environmental-management portion of the screening is worth 70 points, while the sustainability portion is worth 30, for a perfect composite score of 100.

To arrive at their assessments, evaluators use publicly available corporate information combined with the results of a questionnaire submitted to the applicant. Because different types of businesses interact with and impact the environment in very different ways, the criteria for good environmental management differ greatly by industry and business model. The DBJ prepares a variety of rubrics geared to different business models, and it revises its questions yearly in consultation with outside experts. A traditional credit evaluation is also conducted, including credit-risk assessment and collateral valuation.

Supplementing the written information are interviews with the company’s environmental officers or other members of management. This testimony is checked against the results of the primary screening, and any additional information obtained is incorporated in the final assessment. The DBJ considers such dialogue an important aspect of the assessment process. In addition to shedding light on corporate strengths and weaknesses that may not be evident from written information made available to the public, dialogue helps ensure that the company understands and accepts the reasoning behind the DBJ’s assessment.

Figure 2. DBJ Environmentally Rated Loan Approval Process

Source: Created by the author based on a chart on the DBJ website, https://www.dbj-sustainability-rating.jp/en/enviro/overview.html.

Once a mutual understanding is reached, the company is given a rating on the basis of its overall score. Companies deemed eligible for a loan are rated as either “satisfactory,” “advanced,” or “very advanced.” A “satisfactory” rating earns a standard interest rate; an “advanced” rating, a special low rate (special rate I); and a “very advanced” rating, the lowest rate (special rate II). These rate differentials are designed to further incentivize environmentally friendly corporate management.

While the interest rate is based on the company’s environmental rating at the time of the loan-approval process, the DBJ is conscious of the need for companies to maintain their environmental standards thereafter (at least during the loan period). For this reason, it continues to monitor their environmental performance along with their financial situation.

Anticipated and Reported Benefits

As of March 2019, the DBJ had provided 655 ERLP loans totaling ¥1.4 trillion. In 2004, the first year of the program, the recipients were predominantly large companies that had taken the initiative to reduce their environmental burden in high-impact manufacturing industries like paper and pulp, cement, and chemicals, as well as the energy sector. Borrower profiles have become considerably more diverse since then. Nowadays, the program benefits businesses across the spectrum, including processing and assembly and food manufacturing, as well as a wide range of nonmanufacturing enterprises. Medium-sized companies now figure prominently among the program’s users, as was the program’s original intent.

Another noteworthy trend is repeat borrowing. Having once received a “satisfactory” or “advanced” rating from the DBJ, some companies have raised their environmental standards, applied again, and improved their rating. Such cases truly embody the program’s basic purpose of encouraging ongoing improvement in environmental management.

In addition, companies that have received loans under the ERLP have reported the following benefits.

First, they cite the financial merits of an ERLP loan. Companies that meet certain standards for environmental management are able to reduce their finance costs with a low-interest DBJ loan. This can enhance the status of the environmental management office in a company accustomed to viewing environmental management as a cost center.

Second, companies find the DBJ’s assessment and rating useful for internal management purposes. In addition to detailed, objective information from the DBJ’s assessment of their own environmental management, companies have access to a rich fund of comparative data, allowing them to benchmark themselves against other rated companies.

Loans under the DBJ’s Certification Programs (as of March 2019)

|

Type of certification program |

Number of ratings |

Value of loans |

|

|

Environmental |

34 |

655 |

1,424.3 |

|

BCM |

31 |

346 |

424.0 |

|

Health Management |

46 |

183 |

209.2 |

|

Total |

111 |

1,184 |

2,057.7 |

Source: JDB website, https://www.dbj-sustainability-rating.jp/en/about/principles.html.

Third, companies can make use of the assessments in their stakeholder communication efforts, a key element of CSR. Meaningful sustainability reporting involves setting appropriate targets, measuring the company’s progress toward them, and making that information available and accessible to the public. Some companies have become fairly adept at this process, but many others are daunted by the complexities of measurement and evaluation. Sustainability ratings by a respected, independent organization like the DBJ carry considerable weight, and their publication in newspapers or corporate sustainability reports is a good way of communicating the company’s commitment to CSR. In some cases, employee motivation has also improved as a result.

In fact, in this day of ultra-low interest rates, applicants to the DBJ’s ERLP and other certification programs are probably attracted less by the promise of special rates than they are by the usefulness of the DBJ’s sustainability assessments as tools for internal management and external communication.

From the DBJ’s standpoint, meanwhile, the sustainability-assessment system has the merit of lowering transaction costs by minimizing sustainability risks. In addition, these certification programs constitute the centerpiece of the DBJ’s own efforts to integrate CSR into its core business operations.

Summing Up

Amid growing awareness of the SDGs and the problems they seek to address, companies are searching for paths to a sustainable future for themselves and society as a whole. The DBJ’s Environmentally Rated Loan Program shows how financial intermediaries can help guide and power that quest.

Programs like the DBJ ERLP are a means of applying the principles of socially responsible investing to the realm of indirect finance—that is, basing financing decisions on a balanced assessment of corporate value and sustainability, taking full account of nonfinancial as well as financial factors. By offering loans at more favorable interest rates to companies that are deemed low-risk in the light of this comprehensive assessment, financial intermediaries can use the carrot of indirect finance to support socially responsible companies and influence the movement of capital in a way that contributes to sustainable development. Although the flow of funds is small in comparison with ESG investments, the DBJ’s certification programs accomplish something similar in the realm of indirect finance.

While it is difficult to generalize on the basis of one example, I believe the DBJ’s experience offers lessons for financial institutions in the age of the SDGs. Here I would like to focus on the importance of dialogue.

There is no question that more and better sustainability reporting by corporations is needed to promote and expand ESG investing and financing. That said, corporations cannot report everything, and in deciding what to publish and what not to, they sometimes neglect to report information that could be of value to stakeholders. Banks, which tend to cultivate long-term relationships with their clients, are in an excellent position to uncover companies’ hidden strengths in the course of ongoing dialogue. Moreover, at a time when dialogue between corporate management and stakeholders other than investors appears to be on the decline, as revealed by a study conducted by the Tokyo Foundation for Policy Research, banks can compensate by offering the external perspective of a business partner.

Dialogue is also integral to the assessment process outlined above. Banks have a key role to play in identifying sustainable businesses and ensuring that they receive a fair assessment in the financial marketplace. This means analyzing and evaluating the kind of nonfinancial information that can influence a company’s overall sustainability. Dialogue with the business in question is an important component of any such assessment. Going forward, banks will doubtless need to become more adept at using dialogue to uncover their clients’ untapped potential, working alongside ESG investors to chart a path to a more sustainable future.

The opinions expressed herein are the author’s own and do not necessarily reflect the policy or position of the Development Bank of Japan.

Katsuhisa Uchiyama is a senior economist at the Research Institute of Capital Formation, Development Bank of Japan, specializing in environmental economics. He joined the DBJ in 1989 and assumed his current position in 2005 after serving as a research associate at the Center for International Affairs, Harvard University (1997), and associate senior economist at the Research Institute of Capital Formation (1999). He has also been a visiting professor at Gakushuin University’s Faculty of Economics (2015–17) and lecturer at Hosei University’s Faculty of Sustainability Studies.

[1] Tom Tietenberg (1998), “Disclosure Strategies for Pollution Control,” Environmental and Resource Economics, 11 (3–4), pp. 587–602.

[2] https://www.dbj-sustainability-rating.jp/en/about/