- Article

- Tax & Social Security Reform

How Historic Is the New Framework for International Tax Reform? Sizing Up the Two-Pillar Agreement

August 23, 2021

On July 10 this year, the Group of 20 reached a sweeping agreement on a framework for international tax reform to address the challenges of the digital economy. Research Director Shigeki Morinobu, who has followed the OECD/G20 negotiations for years, discusses the agreement’s historic significance.

* * *

On July 10 this year, the finance ministers and central bankers of the Group of 20 reached a basic agreement on a “two-pillar solution” to the challenges of corporate taxation in a globalized, highly digitalized economy. The agreement, coming after almost a decade of deliberation and negotiation, signals a fundamental shift in economic thinking accelerated by the COVID-19 pandemic. In the following, I explain the historic significance of the new framework, as well as some key issues that remain to be settled.

Overview of the Two-Pillar Solution

The G20 communiqué of July 10, 2021, has been hailed as historic, and for good reason. Efforts by the OECD and the G20 to develop new rules of taxation for the digital economy go back to 2012, with the launch of the Base Erosion and Profit Shifting (BEPS) project. However, in its 2015 “final report,” the BEPS project kicked the can down the road, and it was not until this year that its successor, the OECD/G20 Inclusive Framework on BEPS, was able to release the outline of a “two-pillar solution” endorsed by 131 of the 139 participating jurisdictions. Those proposals were formally approved at the July 9–10 economy and finance meeting of the G20 in Venice.

The two basic components of the plan are follows: (1) new rules favoring market countries in the allocation of profits from large multinational enterprises, particularly such digital giants as Google, Apple, Facebook, and Amazon, and (2) establishment of a 15% minimum global corporate tax rate to stem tax competition and the shifting of profits to tax havens. Let us examine the significance of these two proposals individually and consider the issues remaining to be resolved before they can be implemented.

Summary of the Two-Pillar Framework

|

|

Pillar 1: New Nexus & Allocation Rules |

Pillar 2: Global Minimum Tax |

|

Purpose |

Address tax nexus and profit-allocation issues arising from globalization and digitalization of the economy |

Stem base erosion and profit shifting resulting from tax competition by establishing a 15% global minimum tax rate |

|---|---|---|

|

Scope |

Multinational enterprises with global sales above 20 billion euros and profitability above 10% |

Multinational enterprises with global revenues of at least 750 million euros |

|

Key provisions |

• Allocation of at least 20%–30% of residual profits (in excess of 10%) to market jurisdictions |

• Income Inclusion Rule (IIR) allowing countries to impose a “top up” tax on a resident parent company if the effective tax rate for its constituent businesses worldwide comes to less than 15% |

|

Unresolved issues |

Process and timing for removal of unilateral digital services taxes |

Extent of exemptions for substantial economic activity |

|

Legal framework |

Multilateral tax treaty |

Domestic legislation (IIR, UTPR) |

|

Proposed timetable |

Completion and signing of treaty: 2022 |

Enactment of domestic legislation: 2022 |

Source: Compiled from OECD, Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from

the Digitalisation of the Economy, July 1, 2021.

Pillar 1: Taxing Rights for Market Jurisdictions

Pillar 1 of the framework represents a historic departure from the old international tax order in that it allocates substantial taxing rights to market (or user) countries where the profits of multinational enterprises (MNEs) are generated, regardless of where they are headquartered. Targeting the roughly 100 MNEs with global sales of more than 20 billion euros and a profit margin of more than 10%, the plan would allocate between 20% and 30% of those residual profits—that is, profits in excess of 10%—to market countries for taxation purposes. The companies most affected would be tech giants that have been able to avoid paying taxes in countries where they did business as long as they had no taxable presence (“permanent establishment”) there.

Competing Rationales

In previous statements and commentaries, the OECD has cited a number of justifications for this shift. One, which reflects the British government’s position, is the central role of user participation in value creation in the digital economy. Under the dominant digital business model, users get access to various services in exchange for their personal information, which the tech companies use to create new value, aided by logarithms and artificial intelligence. Given the importance of such “user participation” to corporate asset building in the digital economy, it makes sense to allocate a substantial portion of the taxing rights to jurisdictions where the users reside.

From the standpoint of overall economic efficiency and welfare as well, there is certainly something to be said for taxing the excess profits generated from user information acquired virtually free of charge in markets where multinational tech giants hold a virtual monopoly.

The United States, meanwhile, has focused on “marketing intangibles” as the basis for reallocation. Multinationals of all types, the argument goes, must build intangible assets in their market countries, including customer lists and sales networks, in order to generate value. From this perspective, it makes sense to allocate taxing rights based on MNEs’ advertising and marketing activity in market countries.

As currently conceived, Pillar 1 would in fact apply not only to tech firms but also to some large traditional businesses with a global presence. This reflects the emerging consensus that it is neither practical nor advisable to “ring-fence” digital businesses for tax-policy purposes.

Toward a Destination-Based Tax?

The thinking encapsulated above could also open the door to a broader discussion on the merits of destination-based corporate taxation.

Today’s international tax system is predicated on the principle of residency-based taxing rights while also recognizing limited rights based on the source of income. From this dual premise, it relies on foreign tax credits and exemptions to eliminate or minimize double taxation.

The problem with residency-based corporate taxation is that it breeds international tax competition that results in the erosion of the tax base. Because local corporate tax rates are a key factor determining where businesses choose to establish their headquarters, countries have been engaged in a “race to the bottom,” pushing their corporate tax rates lower in a bid to attract or retain businesses. Furthermore, in today’s global digital economy, MNEs headquartered in high-tax jurisdictions often use transfer pricing to shift their profits to foreign affiliates in low-tax jurisdictions. In response, countries have developed a multitude of complicated rules aimed at preventing such international tax avoidance.

One possible solution to the problem would be to switch to destination-based taxation, shifting basic taxing rights from the countries where businesses are based to those where their goods or services are consumed—the same principle followed by Japan’s consumption tax and Europe’s value-added tax.

The main potential advantage of such a system is that it would end tax competition between jurisdictions and remove the incentive for shifting profits. In the process, it would eliminate the need for complex tax laws governing transfer pricing and vastly simplify countries’ corporate tax codes, reducing administrative costs for tax authorities and businesses alike. The border adjustment tax unsuccessfully pushed by Republicans under the administration of US President Donald Trump was a destination-based cash-flow tax, albeit a unilateral one.

Of course, a shift to destination-based corporate taxes would pose a number of challenges. Among these are the difficulties of tax assessment. The European VAT relies on standardized invoices for each transaction to document the taxes paid on imported goods and calculate the refunds businesses can claim on outbound payments. In the case of a destination-based corporate income tax, a business’s net liability, including refunds of taxes paid on exports, would have to be calculated yearly on the basis of internal corporate accounts, making an accurate assessment difficult. Companies that export almost all of what they produce domestically would be eligible for huge refunds, which could prompt a public backlash. Massive tax fraud targeting export rebates could also become a problem.

Moreover, in the absence of a tax invoicing system like that adopted in Japan for the consumption tax, importers could face problems when they attempt to pass the tax along to consumers. Retailers and other import-dependent industries would doubtless oppose any plan that threatened to raise their tax bills or hurt sales. In fact, the US border adjustment tax proposed in 2016 was beaten back by opposition from retail executives and trade groups. The shift in price structure triggered by such a tax could also have a major impact on exchange rates and the flow of trade.

Finally, a destination-based corporate tax would have to be adopted uniformly throughout the world, in a coordinated fashion in order to avert major tax distortions.

Unresolved: Handling the Removal of Unilateral Digital Taxes

The biggest issue that needs to be resolved before a BEPS treaty can be signed and implemented is the procedure and timing for removing unilaterally imposed digital service taxes (DSTs), such as those already introduced in Britain, France, Italy, and Indonesia. The July OECD/G20 statement provides no guidance, stating only that Pillar 1 “will provide for appropriate coordination between the application of the new international tax rules and the removal of all digital service taxes.”

DSTs are indirect taxes levied on sales, above a certain threshold, generated by platformer services, online advertising, and other digital services—typically at a rate of 2%–3%. The advantage of indirect taxes is that each country can apply them at their own discretion, unconstrained by tax treaties. It has also been argued that sales can serve as an adequate proxy for profits when taxing digital businesses, where the marginal cost of production tends to be very low.

The problem is that DSTs have no mechanisms to prevent multiple taxation or the taxation of businesses operating at a loss. The continued proliferation of such taxes at the national and local levels could sow confusion in the digital economy. The adoption of unilateral DSTs has already fueled threats of retaliatory tariffs, which, the OECD warns, could reduce global GDP by more than 1% annually.

Britain’s DST is a 2% levy on revenues derived from British use of such digital services as search engines, social media platforms, and online marketplaces. The tax, imposed on revenues in excess of 25,000 pounds, targets large digital businesses that generate more than 500 million pounds in global revenue and more than 2.5 million pounds in British sales. Collected by means of tax returns submitted by the responsible business entities, the tax is expected to raise between 300 million and 500 million pounds annually.

In Britain and Europe, the DSTs have been characterized as interim measures to be eliminated once an international agreement is complete. But at what point is such an agreement deemed complete? Will countries like Indonesia, which introduced a DST as a means of funding their COVID-19 response, be able to abolish it? With such questions lingering, we can expect some intense negotiation before an implementation plan for Pillar 1 is finalized.

Pillar 2: A Global Minimum Corporate Tax

Pillar 2 of the OECD/G20 agreement would establish a global minimum corporate tax rate of 15%. This would be accomplished by allowing the home country of an MNE to apply a surtax to “top up” the corporate group’s effective tax rate if it paid less than 15% in another country. Let us now explore the significance of this second major component of international tax reform.

Trends in Corporate Taxation

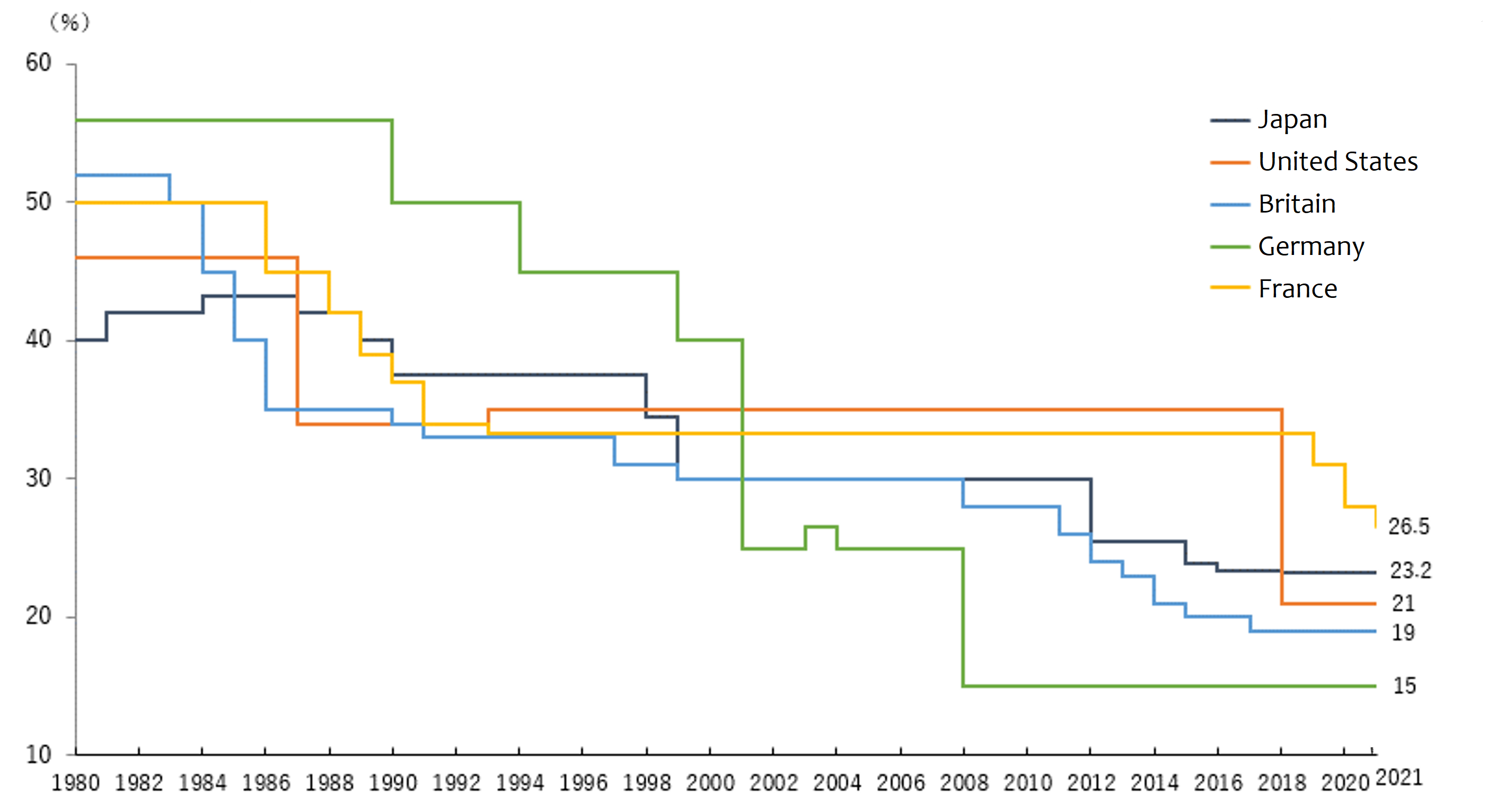

Under the influence of neoliberalism, which made deep inroads during the late 1980s and 1990s, corporate income tax rates were dramatically lowered. The tax reform implemented under the administration of US President Ronald Reagan epitomized this trend. After the end of the Cold War, emerging countries vied with one another to attract new investment with the lure of low corporate tax rates. This escalating competition engulfed the industrial world as well.

Trends in Corporate Tax Rates (nominal rates)

Note: As of January 2021.

Source: Ministry of Finance (Japan) statistics.

With big business going global, the dominant neoliberal economic theory of the time regarded international tax competition as a positive force. However, as competition drove tax rates down, many countries saw their tax base erode, as easily shiftable income, including certain corporate revenues and investment income, flowed overseas to tax havens. To make up for lost tax revenue, they had no choice but to raise taxes on consumption and forms of income that were harder to shift overseas. This raised issues of fairness in addition to causing distortions in economic activity.

In the second half of the 1990s, the OECD launched a study group on “harmful tax competition,” but the conclusions amounted to little more than a one-sided rebuke of tax havens. The world’s industrial, emerging, and developing countries continued to engage in a game of “chicken” over corporate tax rates.

More recently, opponents of reform have pointed to empirical research indicating that tax revenues in the EU increased as a percentage of gross domestic product, despite reduced corporate tax rates. Neoliberal economists cited these findings in support of the notion that tax competition stimulates economic vitality by encouraging business innovation and entrepreneurship. But others have argued convincingly that the increase in tax revenues was made possible only by broader reforms, such as those implemented in Germany, that expanded the tax base by removing tax breaks and loopholes while lowering the corporate tax rate.

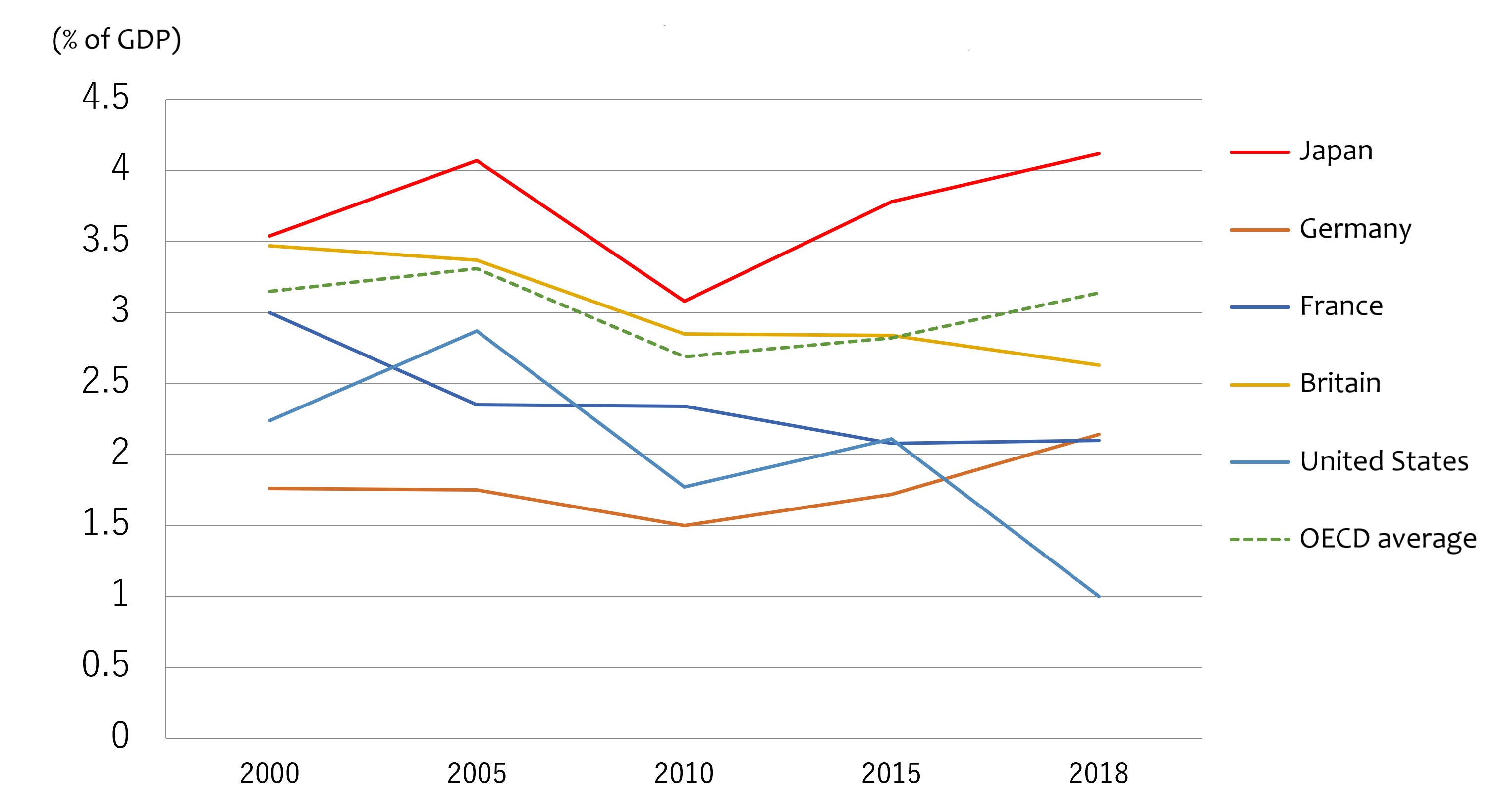

Trends in Corporate Tax Revenues as Percentage of GDP

Source: OECD revenue statistics.

In Japan, revenues from corporate taxes declined as a percentage of GDP from the early 1990s to around 2010. One reason was undoubtedly the long-term economic stagnation that followed the bursting of the asset bubble. But the “Obuchi tax breaks” introduced from 1999 on also contributed, especially as they were not accompanied by measures to expand the tax base.

Corporate tax revenues grew after 2012, despite continuing cuts in the corporate rate, under the influence of Prime Minister Shinzo Abe’s pro-business policies. The reason was that Abe’s tax reforms, like those carried out in Germany, were revenue-neutral, incorporating measures to expand the tax base. But the bump in corporate profits under Abenomics did not trickle down to the broader economy, as Japanese companies chose to sit on their extra earnings or distribute them as dividends instead of using them for capital investment or payroll.

Altogether, the OECD has estimated that between $100 billion and $240 billion in taxes are lost to base erosion and profit shifting each year. Pillar 2, which the OECD estimates will generate an additional $150 billion in tax revenue annually, signals a historic rejection of “race to the bottom” tax competition.

Unresolved: Treatment of Tax Incentives for Foreign Investment

A key question that remains to be resolved is the treatment of targeted tax breaks and incentives put in place to attract investment by foreign manufacturers and others engaged in substantial economic activity. The effect of such incentives is to lower the effective tax rate on the investing companies. However, permitting the home countries to tax make up for such breaks would undermine their efficacy as an incentive for investment. The latest agreement calls for a “substance-based carve-out,” which proposes to keep the focus on intangible-related residual profits by exempting a portion of a company’s income based on its tangible assets, but the precise criteria for exemption still need to be worked out. Japanese companies that have benefited from tax incentives in China and elsewhere have a major stake in the outcome of those negotiations.

Notwithstanding the unresolved issues touched on above, the agreement on the two pillars is indeed a historic milestone given overarching trends in corporate taxation over the past three decades and the slow progress of reform until this year.

The immediate impetus for the breakthrough came from the administration of US President Joe Biden, which embraced the push for an agreement as part of its broader shift toward international cooperation, as well as a means of furthering its domestic agenda (which calls for an increase in corporate taxes). A more fundamental factor, however, is the international shift in economic thinking. Growing misgivings about global laissez-faire capitalism and tax avoidance by the big MNEs have been amplified by the impact of the COVID-19 pandemic and the practical need to replenish public coffers. The pendulum is swinging toward economic and tax policies geared to the needs of society. This, above all, is the historic significance of the two-pillar agreement.