Japan’s Price Inflation: Bad, Good, or Irrelevant?

July 7, 2022

R-2022-015E

Former Bank of Japan Executive Director Hideo Hayakawa considers the implications of Japan’s recent cost-push inflation in the context of ongoing wage stagnation and nine years of failed monetary policy.

* * *

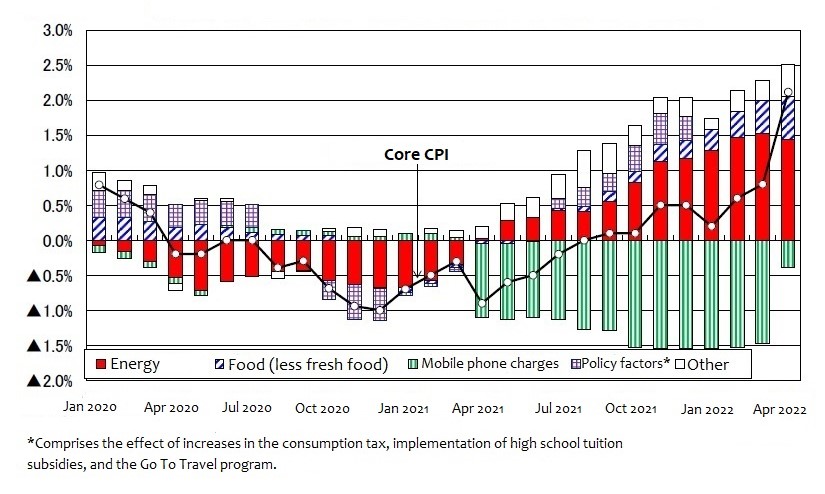

After many years of deflation, Japan is grappling with the reality of higher living costs. As shown in Figure 1, the year-on-year rise in Japan’s consumer price index (excluding fresh foods) jumped from 0.8% in March to 2.1% in April. To be sure, this was mainly due to the fact that mobile phone rates, which were lowered about a year earlier, had largely stabilized. Moreover, the year-on-year increase in the CPI would be a manageable 0.8% if energy prices are excluded—a far cry from the severe inflation menacing many Western economies. All that said, it was something of an event when Japan’s inflation rate finally topped the 2% target set by the Bank of Japan, especially given that the previous peak during nine years of ultra-loose monetary policy was a mere 1.5% in April 2013 (discounting the effect of consumption tax hikes).

Figure 1. Changes in Japan’s Core CPI by Category (percent change from year earlier)

Source: NLI Research Institute, https://www.nli-research.co.jp/report/detail/id=71146, April 2022.

The trend is likely to continue in the coming months. Although the government is using subsidies to keep gasoline prices down, electricity and gas rates continue to rise. Even without that, increases in food, restaurant meals, and household items should be sufficient to push the core CPI higher, judging from real-time reports.[1] Meanwhile, the residual impact of lower mobile phone rates on the CPI (–0.38% in April) will disappear, pushing the index up further. Thus far in this century, Japan’s biggest year-on-year rise in the cost of living (excluding the effect of consumption tax hikes) has been 2.4% posted in July and August 2008 (just before the global financial crisis), amid a spike in global fuel and food prices. We could well surpass that in the near future.

Inflation Outpacing Forecasts

While energy prices remain the biggest factor behind the rising cost of living, there are signs that price inflation is accelerating and spreading through the economy more rapidly than anticipated.

One indication is the fact that average inflation forecasts rose in April and May, even though crude oil prices had peaked in March. In the March ESP Forecast (based on a survey of 40 leading forecasters), the consensus forecast for year-on-year consumer price inflation in the April–June quarter of 2022 was 1.65%. That figure rose to 1.78% in April and 1.94% in May. Similarly, the consensus for the annual (fiscal 2022) inflation rate rose from 1.51% in March to 1.83 by May. The most natural explanation is that core inflation outpaced the experts’ initial forecasts, and they adjusted their outlook to keep pace with reality. Given that virtually no one anticipated an April inflation rate exceeding the 2% target, the upward revision of these forecasts is likely to continue into June.

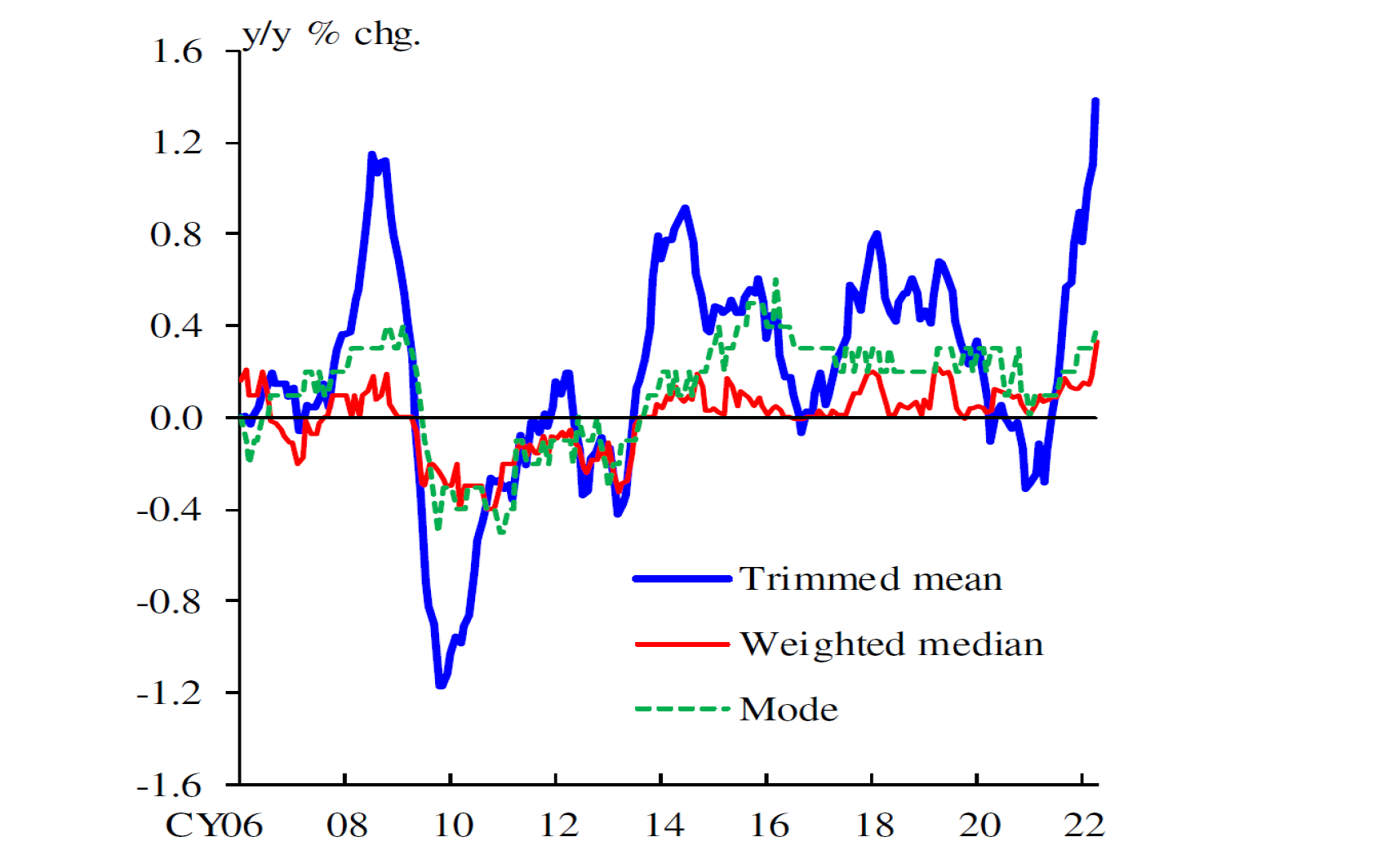

A second indication of spreading price inflation can be found in the BOJ’s measures of underlying inflation, published monthly (Figure 2). The weighted median (the inflation rate of the items in the middle of the distribution of price changes in the CPI basket) and the trimmed mean (the average rate of inflation after the top and bottom deciles are eliminated) have already surpassed the peaks hit in the summer of 2008 (a development to which the market briefly reacted). While not yet a cause for serious concern, these trends do suggest that price gains are spreading more widely than initially anticipated.[2]

Figure 2. Measures of Underlying Inflation

Source: Bank of Japan, https://www.boj.or.jp/en/announcements/press/koen_2022/data/ko220601a2.pdf, June 1, 2022.

A third indicator that bears watching is changes in the GDP deflator. A rise in the cost of raw material imports, such as petroleum and foodstuffs, will cause no change in the GDP deflator if prices rise exactly in line with cost increases. If costs are not fully passed onto prices, the deflator will fall, and if prices are raised beyond cost increases, the deflator will rise. Japan’s GDP deflator rose from –1.3% in the fourth quarter of 2021 to –0.5% in January–March 2022 (an increase of 0.3%), indicating that costs were passed on. This is a key difference between the current situation and the period prior to the 2008 financial crisis, when the GDP deflator fell by 1.3—1.4 points each quarter until the crisis hit. Moreover, given that the drop in cell phone rates was holding the consumer price deflator down as late as March this year, the GDP deflator for the April–June quarter could even show a year-on-year increase. A GDP deflator that is no longer in negative territory would force us to rethink the conventional understanding that Japanese businesses are struggling because they find it so hard to pass on the rising cost of energy and material imports to consumers.

Growing Tolerance of Price Increases

The next question is why price inflation is spreading. Speaking to this question in a television broadcast last May, economics Professor Tsutomu Watanabe of the University of Tokyo made some interesting observations, drawing on his own consumer surveys.

To begin with, Watanabe found that a growing number of Japanese consumers are expecting the cost of living to continue rising. This in itself is no surprise; the BOJ’s latest Opinion Survey on the General Public’s Views and Behavior, completed in March, also recorded an increase in such expectations.[3] When prices are rising, inflation expectations tend to rise with them.

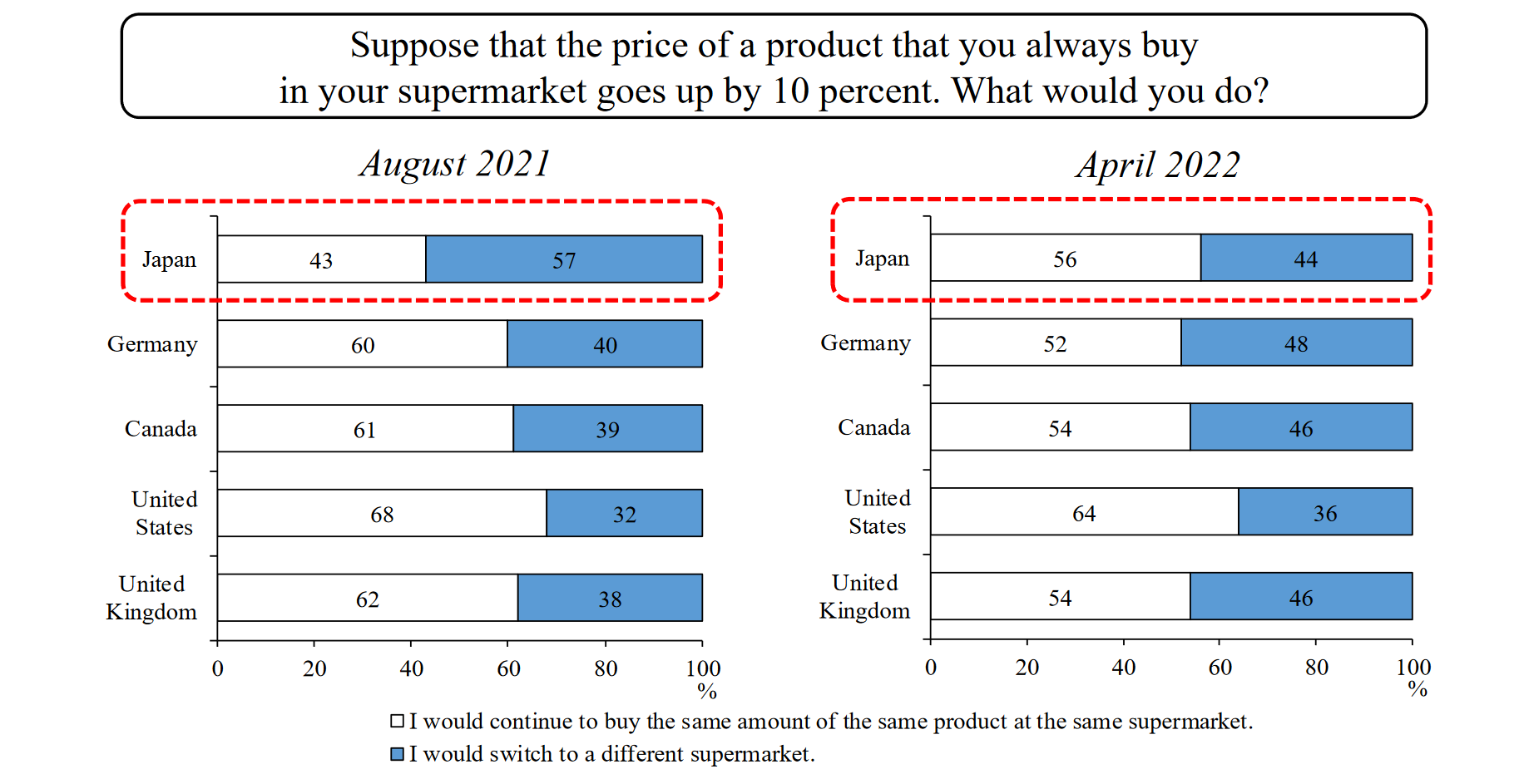

More noteworthy was the second finding: a growing tolerance for, or acceptance of, price hikes among Japanese consumers. Watanabe’s questionnaire survey asks consumers in Japan and four Western countries what they would do if a store they frequented raised the price of a product they customarily bought there by 10%. When he conducted the survey in August 2021, just 43% of Japanese respondents said they would continue shopping at that store (as compared with 60% or more of those polled in the West). That result was consistent with one of the main theses of Watanabe’s 2022 book Bukka to wa nani ka (What Is the Cost of Living?)—that prices have continued to stagnate in Japan in part because of the mentality of Japanese consumers, who are intolerant of even small price increases. Watanabe explains this intolerance as a social “norm” that took root during the decades of deflation.

Yet in April 2022, the same survey yielded a very different result: those saying they would keep shopping at the same store now reached a majority of 56% (roughly in line with the shares found in the West). In a June talk hosted by a news agency, Bank of Japan Governor Haruhiko Kuroda, citing Watanabe’s research, suggested that Japanese consumers might be growing more tolerant of price hikes.[4] Although he was obliged to retract the statement in the face of intense criticism, the evidence is hard to ignore.

Figure 3. Results of Consumer Survey on Price Increases

Source: Bank of Japan, https://www.boj.or.jp/en/announcements/press/koen_2022/data/ko220606a2.pdf (lecture by Governor Haruhiko Kuroda, June 6, 2022).

For years, Japanese companies have taken pains to explain to consumers the need for the smallest price hike, even when the increase was justified by rising costs or other factors. Since most households had to make do without wage increases, the thinking went, companies should also resist the temptation to raise prices. But Watanabe’s research suggests that zero tolerance for price hikes is eroding. The question is, why?

One possible explanation is the psychological impact of the war in Ukraine. It could be that Japanese consumers, having been inundated since late February with news and images of the horrors in Ukraine, suddenly feel they should not be grumbling about a 50-yen increase in the price of lunch. In an April public opinion poll carried out by Kyodo News, 73.7% of respondents said that Japan should maintain its sanctions against Russia in coordination with the West, even if they had a negative impact on Japanese businesses and consumers. A behavioral economist might posit that consumers were more disposed to accept higher food and energy prices when those increases are “framed” as the cost of supporting Ukraine in the face of Russian aggression.

Can Japan Sustain Moderate Inflation?

Do the shifts observed of late raise hopes for a steady, moderate rate of inflation going forward—that is, an end to the deflation that has plagued Japan since the mid-1990s?

The answer depends on one’s ideas about the basic mechanism behind Japan’s deflation, which fall broadly into two camps. The first, championed by the BOJ, views expectations as the key. (Watanabe has said that the “norm” of which he speaks is a type of expectation, though I myself would be inclined to distinguish between the two words). Nine years ago, the central bank launched an unprecedented program of quantitative easing in the belief that an ultra-easy monetary policy would raise inflation expectations and bring the 2% inflation target within reach. In a Comprehensive Assessment carried out in September 2016, the BOJ concluded that it would take time to reach the target because Japan had become mired in a “deflationary mindset.” Nonetheless, the BOJ remained committed to the idea that inflation expectations were the key to getting prices moving upward and that an ultra-loose monetary policy would eventually raise such expectations.

Viewed from this perspective, recent signs of higher prices and greater tolerance for such increases might give the appearance of a sea change auguring a new era of sustained inflation. In addition, the weakening of the yen, though widely treated as a negative development, could further fuel inflation expectations if it continues.[5]

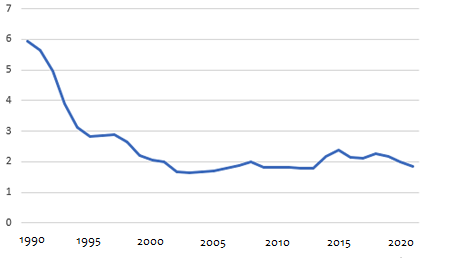

However, there is another school of thought, represented by Rissho University President Hiroshi Yoshikawa, that identifies stagnant wages as the basic cause of deflation.[6] Seen from this viewpoint (one with which I have long sympathized), the outlook is considerably dimmer. This year’s shunto (spring labor offensive) negotiations at Japan’s top corporations are believed to have yielded a paltry 2% average increase. Some have hailed this as progress, but a full 1.8% of that consists of scheduled pay-scale raises; the base-pay increase is negligible. When the cost of living is taken into account, real household income is bound to fall on average. That is a big concern for the larger economy, since it will blunt the hoped-for post-pandemic rebound in consumer demand. And with the Ukraine war and China’s economic slowdown depressing the market for Japanese exports, internal demand could be crucial to Japan’s economic recovery.[7]

Figure 4. Outcome of Shunto Wage Talks at Major Japanese Firms (percent average increase)

Source: Ministry of Health, Labor, and Welfare, https://www.mhlw.go.jp/content/12604000/000816700.pdf.

The failure of Japanese companies to provide substantial raises is especially disappointing inasmuch as the current environment is fundamentally conducive to wage hikes. According to the BOJ’s Tankan, the diffusion index for employment conditions suggests a significant labor shortage, close to levels recorded during the height of Japan’s labor shortages in 2017, when the job-offers-to-applicants ratio was 1.4. Furthermore, ordinary income in the manufacturing sector is approaching record levels. Unless the recent increase in the cost of living is reflected in next year’s wage increases, expectations of and tolerance for price inflation are bound to subside. (The framing effect of the Ukraine crisis is sure to wane as media coverage tapers off.) Even if business activity returns to pre-pandemic levels, we will be in no better shape than we were in the days of Abenomics, when the inflation target remained stubbornly out of reach because companies refused to boost wages even amid rising profits and labor shortages. Without wage increases, Japan will find itself back to square one.

[1] Many news websites track the price of food and other household goods. See, for example, Tokyo Web, https://www.tokyo-np.co.jp/article/163227.

[2] Prices have climbed sharply in the categories of household durables and recreational goods. Some of this increase may be due to the fact that items that used to be made in Japan—notably refrigerators—are now mostly imported, and their price is therefore affected by the weak yen.

[3] The percentage of respondents who believed that the cost of living would be “considerably higher” in a year’s time rose from 13.4% in December 2021 to 20.4% in March 2022. Those who thought it would be substantially higher after five years rose from 26.4% to 33.1%.

[4] Haruhiko Kuroda, “Kin’yu seisaku no kangaekata: Bukka antei no mokuhyou no jizokuteki/anteiteki na jitsugen ni mukete” (The Rationale behind Monetary Policy: Toward Sustained, Stable Realization of the Target for Price Stability), Lecture to Kyodo News Kisaragi-kai, June 6, 2022, https://www.boj.or.jp/announcements/press/koen_2022/data/ko220606a1.pdf.

[5] That said, the Outlook for Economic Activity and Prices released by the BOJ in April 2022 forecasts an annual inflation rate of 1.9% in 2022 and just 1.1% in 2023. (The May 2022 ESP Forecast is even less optimistic, predicting 0.91% inflation in 2023.)

[6] See Hiroshi Yoshikawa, Defureshon (Deflation), Nikkei Publishing, 2013.

[7] In the aforementioned lecture, Kuroda made it clear that rising energy prices are not conducive to sustained, stable price increases, and he stressed the importance of wage increases. However, this view (with which I concur) calls into question earlier statements and actions by the BOJ. When crude oil prices plummeted in October 2014, the central bank decided to expand its QQE (quantitative and qualitative easing) measures on the grounds that lower energy costs threatened to blunt inflation expectations (https://www.boj.or.jp/en/announcements/release_2014/k141031a.pdf). It also maintained that expanding the monetary base would lead to higher wages, though the logic behind that assertion is unclear. It would be interesting to know whether Kuroda has since rejected those views.